|

The wind-turbine industry should be booming. Why isn’t it?

Stiff competition has combined with rising costs

and other burdens

By Staff Writers

May

18, 2023

Given the political weather, Western makers of

wind turbines should be flying high. America’s Inflation Reduction Act

is stuffed with goodies for all sorts of renewable energy. In late

April European leaders pledged to increase the North Sea’s

offshore-wind capacity to 300 gigawatts by 2050, from about 100

gigawatts today and double a previous commitment. That looks like an

awful lot of future business for turbine manufacturers. If only

shorter-term forecasts were as clement.

The four biggest Western makers of wind turbines—ge Renewable Energy,

Nordex, Siemens Gamesa and Vestas—supply about 90% of the market

outside China. Together they made revenues of €42bn ($46bn) in 2022.

But whereas wind-farm operators benefited handsomely from high

electricity rates after Russia invaded Ukraine in February last year,

the turbine-makers sank into the red and their suppliers barely made

money.

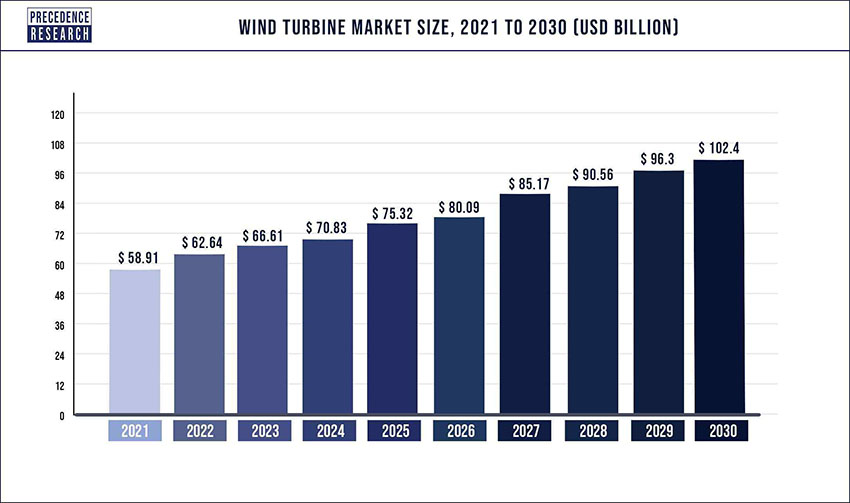

The global wind turbine market size was estimated

at US$ 55.91 billion in 2021 and it is expected to worth around US$

102.4 billion by 2030, growing at a CAGR of 6.34% in the forecast

period 2022 to 2030.

In order to convert the wind energy into electric

energy, wind turbines are used in the wind power plants. The electric

energy is derived due to the aerodynamic force of the rotor blades.

The conversion of the aerodynamic force to the rotation of a generator

produces electricity. As various governments are adopting initiatives

to combat the climate change renewable energy is experiencing great

growth. With the COVID-19 outbreak in 2020, the growth of the wind

turbine market was impacted in terms of delays in manufacturing and

delays in the supply of raw material or the supply of new turbines. So

all of these were the challenges faced by the wind turbine market.

COVID-19 had impacted almost all the industries across the globe. The

industrial operations were affected due to delays in the supply

chains. The operations of many companies were halted due to the

absence of workforce. Apart from that many vendors have migrated to

their hometowns due to the uncertainties in the income during the

lockdown so the production and manufacturing activities had come to an

halt. Even during the forecasted the growth could be hampered due to

the shortage of workforce. The import and export activities were also

impacted which directly affected the wind turbines market.

Growth Factors

As the governments are taking initiatives to produce renewable energy

there is a growth in the market. An increasing demand for renewable

energy sources, especially the wind power and efforts to reduce the

dependence on fossil fuel based power generation are expected to be

the major factors for the rise of this market. Many tax benefits and

incentives are provided by the governments which are helping in

reducing the prices of the components so it is expected to give a

boost to the wind turbine market. Across many developing nations,

there is a mismatch in the supply and demand so there is a surge in

the wind turbine market.

In the offshore installation of the wind turbines, the companies are

being able to install taller turbines and also larger blades in order

to sweep more area than the smaller turbines. As the size of the wind

turbines has grown, it has also helped in lowering the cost of wind

energy. The adoption of offshore wind markets for the wind energy with

the help of advanced technologies has attracted many nations and

companies for high investments. The wind energy is variable. If the

wind doesn't flow, no electricity is generated. The wind energy

industry is still blooming due to the efforts taken by the various

nations across the world to combat climate change, such as the Paris

Agreement.

Report Scope of the Wind Turbine Market

|

Report Coverage |

Details |

|

Market Size by 2030 |

USD 102.4 Billion |

|

Growth Rate from 2022 to 2030 |

CAGR of 6.34% |

|

Largest Market |

Asia Pacific |

|

Fastest Growing Market |

North America |

|

Base Year |

2021 |

|

Forecast Period |

2022 to 2030 |

|

Segments Covered |

Axis, Installation, Components, Application, Capacity,

Connectivity, Rating, Region |

|

Companies Mentioned |

General Electric company., Vestas Wind Systems A/S, Nordex

SE., Suzlon Energy Limited., Siemens Gamesa renewable energy.

SA, CSIC., Shanghai Electric., Windey |

Axis Insights

Depending upon the axis of the wind turbine, the vertical

segment is expected to dominate the global market and it is expected

to remain the fastest growing segment in the forecast period as the

main features of this type is it provides high efficiency at lower

price.

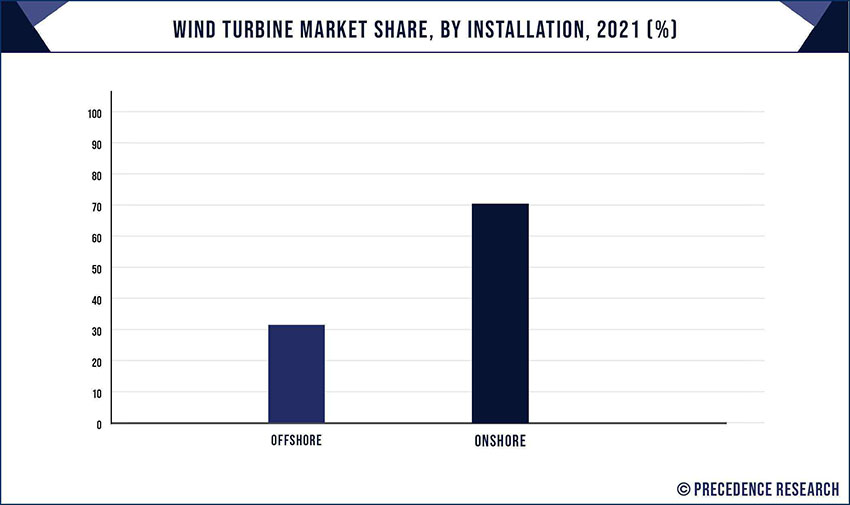

Installation Insights

On the basis of the installation, the global wind turbine

market can be classified into either onshore market or the offshore

market. Onshore market has been on the high till 2021 and it is

projected to remain the fastest growing segment even during the

forecast period. The onshore wind market is expected to grow rapidly

during the forecast period owing to the factors like higher demand for

the onshore installation as compared to the offshore installation.

-

The offshore wind turbine installation is expected to grow during

the forecast as the major companies in the countries are turning

towards the adoption of renewable energy sources and clean energy

sources. The offshore wind turbine provides many other benefits like

improved power generation due to consistent wind flow and quick

installation of the turbines.

Components Insights

The wind turbine market has many components and based on the

components it can be classified into rotator blade, Generator,

gearbox, nacelle and others. The rotator blade segment has dominated

the market till 2021 and it shall rise during the forecast the

reason being rapid industrialization and increased power industries.

Application Insights

The various applications of the wind turbines are industrial

applications, commercial applications, utility and residential

applications. The utility segment has dominated the market till date

and it is expected to grow during the forecast as the Governments

are making stringent policies in order to have sustainable renewable

projects. Due to rapid urbanization and rapid expansion of local

production the demand in the residential application is expected to

rise.

Regional Insights

The Asia Pacific region is expected to be the largest and the

fast paced market as they have the largest wind power generation and

the presence of manufacturing and technological hubs in various

countries like India, Japan and China. The installation capacity in

China has dominated the Asia Pacific market. The fourth largest wind

power installed capacity is held by India. The major projects are

situated in the northern, western and the southern parts of the

country. The Indian government aims to achieve 60 gigawatts, by the

end of 2022. Major companies are investing in the Asia Pacific

market.

North America is the biggest segment for this market in terms

of region. It is due to the rapid infrastructure expansion and due

to the implementation of various offshore wind projects the global

wind turbine market has Asia Pacific region as the fastest growing

area and it is expected to grow during the forecast. The main

reasons for the growth in this region are the increasing population

which provides a large consumer base and an ever increasing demand

for the renewable sources of energy.

Key Market Players

-

General Electric company.

-

Vestas Wind Systems A/S

-

Nordex SE.

-

Suzlon Energy Limited.

-

Siemens Gamesa renewable energy. SA

-

CSIC.

-

Shanghai Electric.

-

Windey

Recent Developments

GE Renewable Energy announced that they will be supplying 42

units of 2.7-132 onshore wind turbines for the wind projects, which

will be a total of 110 megawatts in India , which will help in

meeting the electricity demand of various industrial companies in

the states of Gujarat as well as Karnataka during the forecast

period.

In 2021, GE Renewable Energy and Toshiba Energy solutions

along with Solutions Corporation announced a partnership to localize

the critical phases of the manufacturing of GE Haliade X which is an

offshore wind turbine and support the commercialization of this

turbine in Japan.

JSW energy Ltd which is a part of JSW group has ordered 810

MW of onshore wind turbines from GE Renewable energy for its

upcoming projects in Tamil Nadu.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|