|

14 September2023

By

JOHN FITZGERALD WEAVER

A terawatt of solar module capacity

expected within 16 months

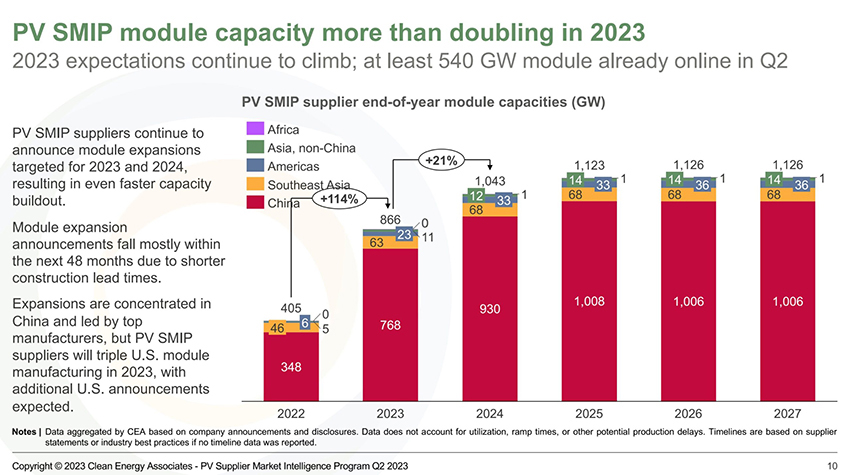

Clean Energy Associates projects that major Chinese manufacturers will

achieve a global solar module manufacturing capacity of 1 terawatt by

the end of 2024. Furthermore, this capacity is projected to hit that

same mark within China’s borders by 2025.

Image: TheOtherKev, Pixabay

The terawatt era has arrived, and the world is

unprepared. As the industry explodes in volume, solar and related

professionals must prepare, adapt – and deploy.

In its recent Q2

PV Supplier Market Intelligence report,

Clean Energy Associates (CEA) highlighted significant growth in solar

module manufacturing by Chinese solar module manufacturers. From a 405

GW manufacturing capacity in 2022, a projected 114% increase is

expected, reaching 866 GW by the end of 2023. Following that, a

subsequent 21% surge in 2024 will bring the total to an impressive

1.043 TW globally.

This rapid growth surpassed many industry

predictions. Still, insiders within the Chinese government, having

played a pivotal role in this boom, likely foresaw such a rise.

A closer look at the numbers reveals that by the end of 2024, Chinese

domestic capacity could be responsible for approximately 0.93

terawatts of their total global capacity. Southeast Asia is

anticipated to account for less than 7% (0.068 TW), the Americas just

over 2% (0.023 TW), and non-China Asian markets might contribute about

1% (0.011 TW).

Major, European and American manufacturers, such as Meyer Burger and

First Solar, were not considered in this study. The assessment

predominantly revolved around:

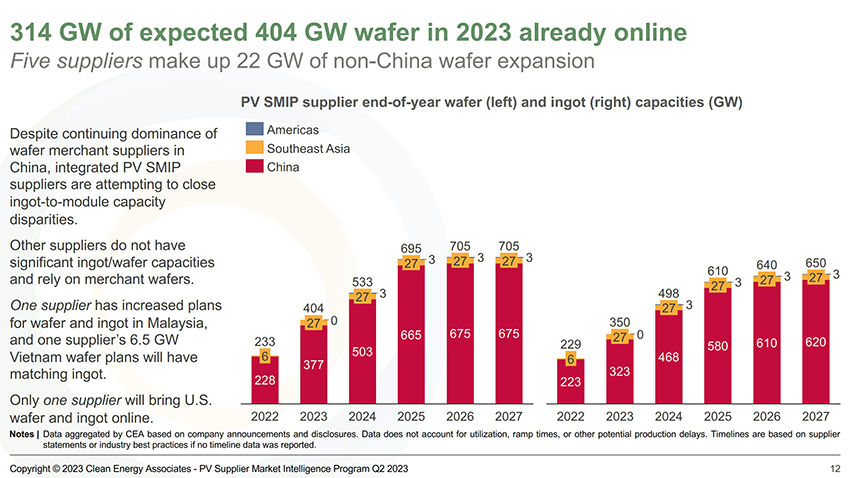

The majority of this capacity is earmarked for

n-type solar cells. Yet, a bottleneck seems evident in the production

process. CEA’s data suggests that cell production lags behind module

manufacturing, with wafer and polysilicon ingot capacities trailing by

several hundred gigawatts.

China’s heavily centralized solar power market, underpinned by

extensive governmental oversight, might see these predictions shift.

Whether solar module manufacturing capacities will be fine-tuned

remains uncertain.

Aligning with – and surpassing – these projections, Bernreuter

Research suggests that long term Chinese plans include up to 3.5

TW of manufacturing capacity by 2027.

PVEL’s findings indicate that the 3.5 million metric tons of capacity might

be operational by the end of next year.

Considering 2.2 grams of polysilicon are required for a watt of solar

panels, PVEL estimates that polysilicon supplies could generate 1.6 TW

of solar modules.

If we build it, will they come?

The question remains: if this manufacturing capacity is available,

will there be adequate installers, grid capacity, and batteries to

absorb the surplus daytime production?

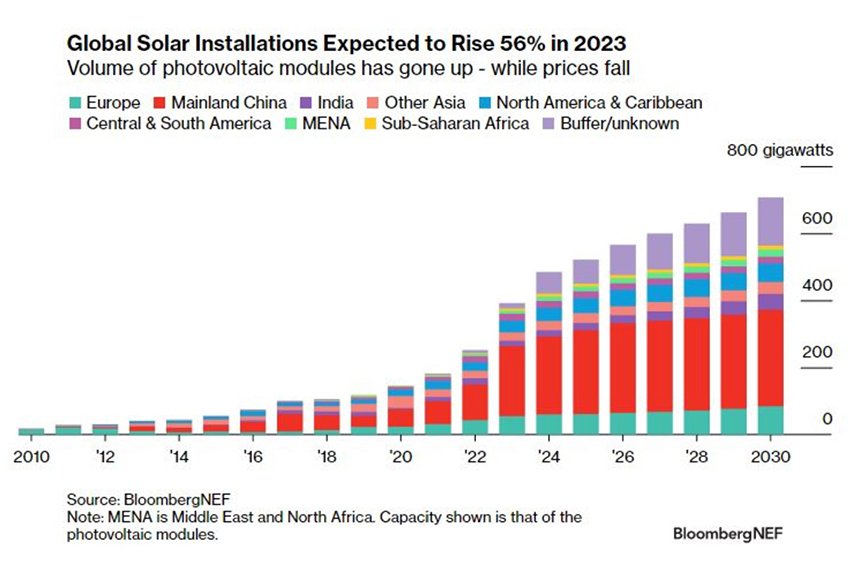

Analyst Jenny Chase of BNEF splashed a little

cold-water on our enthusiasm, pointing out the reality that

oftentimes, solar module factory capacity is 1.5 to 3 times greater

than actual installed capacity. Underutilization of manufacturing

capacity is normal.

Chase noted:

"Maybe 1TW will be installed in 2025, but not

just because the module factories exist."

BloombergNEF’s recent projections estimate 392

GW to be installed in 2023 and around 500 GW in 2025. These

figures are based on their medium volume projections, though they also

offer both lower and higher range projections.

Integrating such a large volume safely into the power grid poses

daunting technical challenges. The U.S., the world’s second-largest

solar market, has experienced delays in interconnections, slowing

solar’s rapid ascent. Specifically, the PJM territory, within the

broader United States’ Eastern Interconnection region, halted

all new renewable energy projects for two years while

grappling with hundreds of gigawatts of projects vying for grid

access. As the U.S. interconnection queue nears

2 TW of capacity,

both the time

and cost of connections have escalated.

State markets have also put the brakes on their local distribution

markets. When Massachusetts’ SMART program was launched, National

Grid’s territory was overwhelmed with applications, causing unforeseen

halts in development. Using public data, pv

magazine USA predicted that National Grid’s area would instantly

fill its entire 800 MW project tranche. Our

prediction was spot on. Yet, the utility expressed astonishment,

stating, “we’re

all a little surprised by how quickly we got to this saturation.”

As a result, they slammed the brakes on development, putting a billion

dollars of projects on standby.

This unexpected turn prompted a state investigation. Despite this,

grid connections remained sluggish, and currently, numerous

substations within the state can’t accommodate additional solar

projects.

China, the world’s largest renewable market, initially managed the

surge in wind and solar by curtailing

excess generation. They later developed a nationwide

high voltage direct current (HVDC) network to channel power from

the interior regions to the densely populated coast.

The growth rate of solar energy is undeniably accelerating. Having

achieved our first

terawatt of installed solar in early 2022, discussions swiftly

transitioned to reaching 1

TW of capacity annually before the end of the decade. We then

speculated that a

second terawatt might be realized in just three years.

There’s a budding optimism that we might witness a unique milestone: a

terawatt installed within a single year in the near future. Truly,

that would be an accelerating transition.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212

|