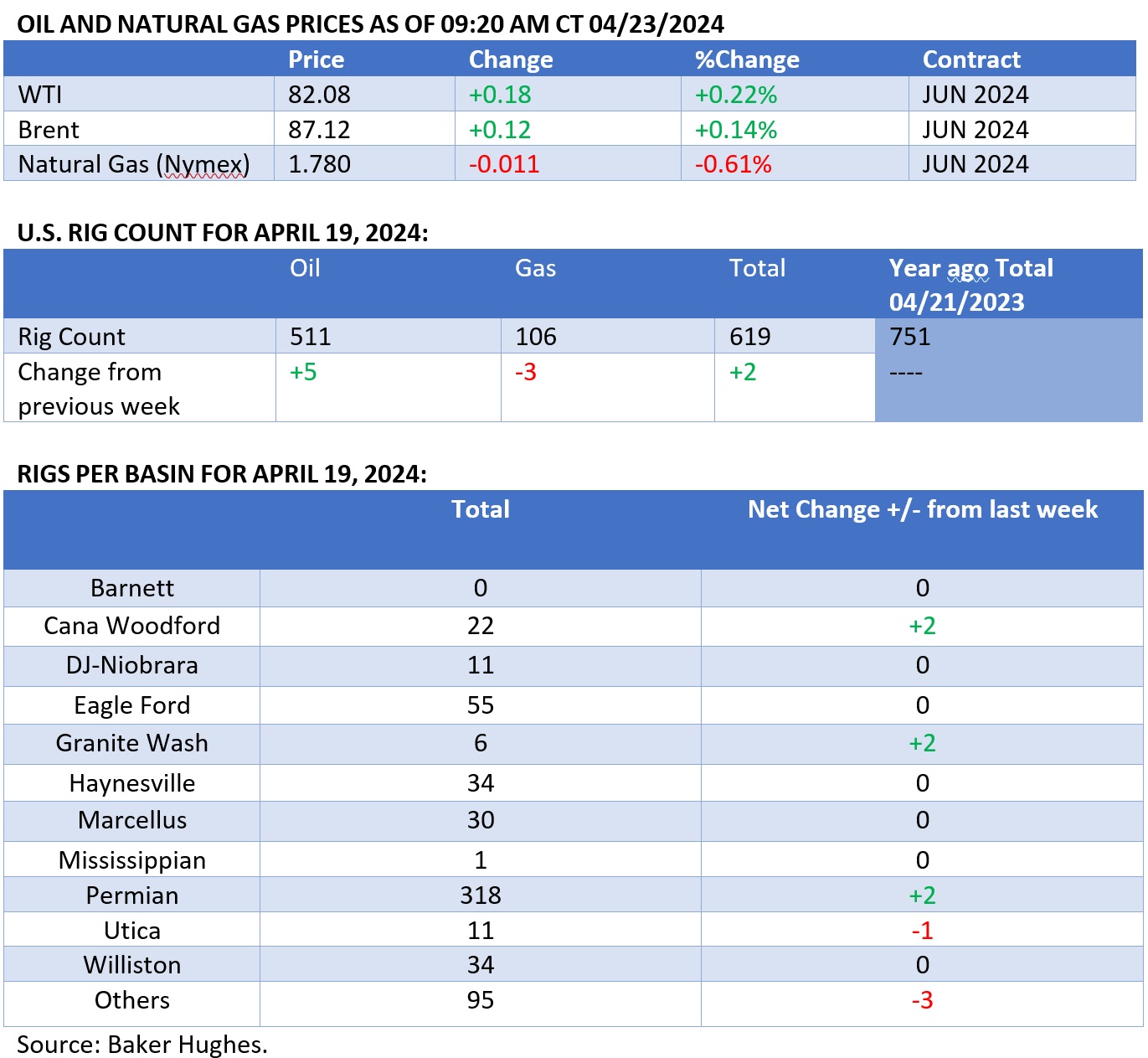

WTI crude hangs above $80 per barrel as

geopolitical risks

have eased somewhat, but haven't disappeared altogether.

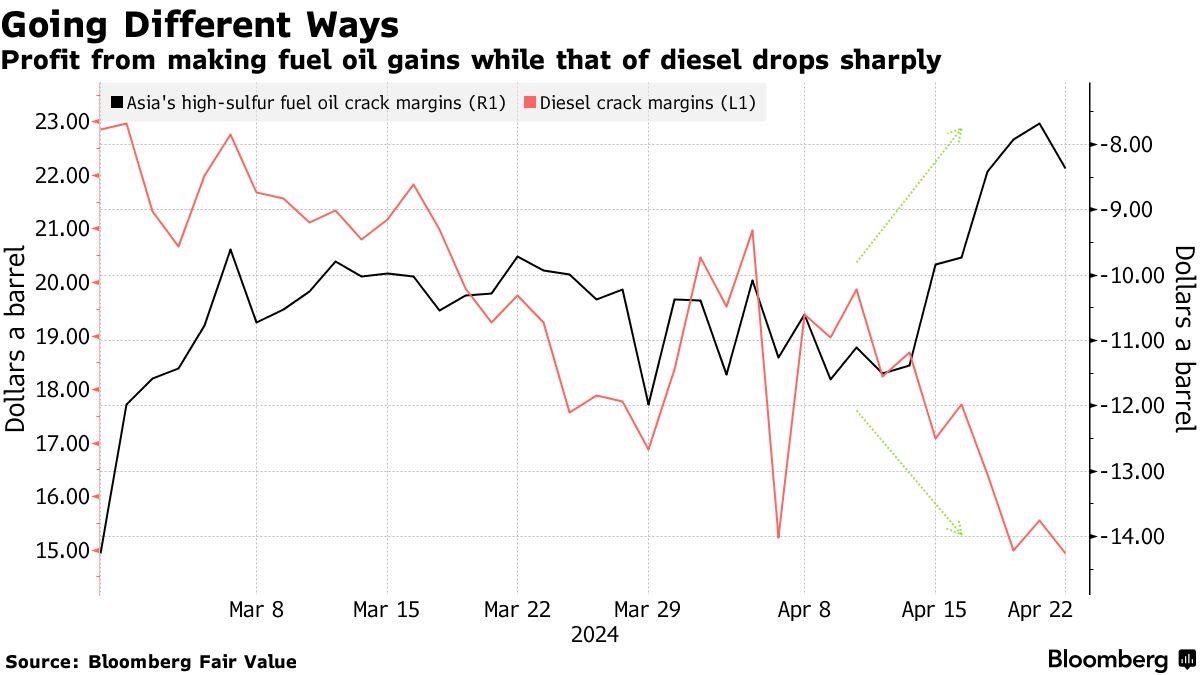

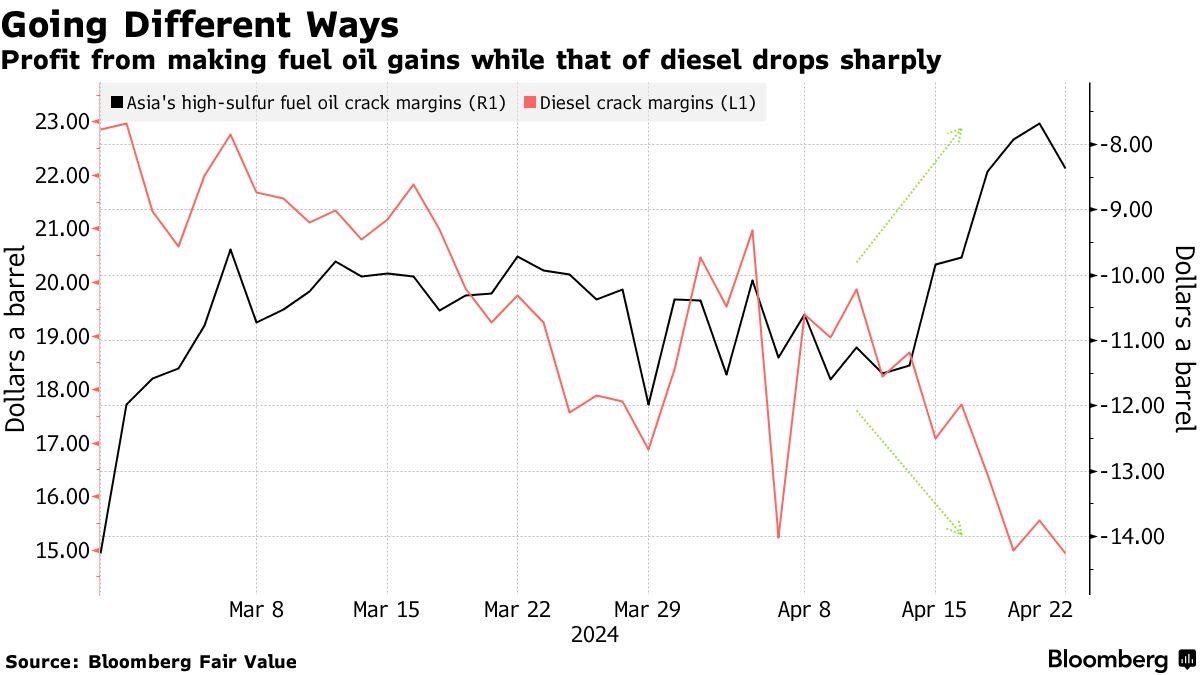

Fuel Oil Is Having Its

Sunshine Moment

- Fuel oil has risen to

prominence

as the most improved oil product of late, boosted by higher demand

from Asia’s power generation sector as well as limited supply of

heavy crudes required to produce it.

- The US’ snapback of sanctions against Venezuela and Mexico’s

sudden cut to exports of heavy sour grades such as Maya have greatly

limited the pool of heavier crudes Asia could buy, just as OPEC+

keeps on restricting its production by voluntary cuts.

- The collapse in Asian and European diesel cracks, both down $6-7

per barrel since the beginning of April, came on the heels of higher

refinery runs, however fuel oil wasn’t as abundant with ship

bunkering and increasing power generation demand from countries like

Pakistan or Saudi Arabia kept supply limited.

- With Asian and US fuel oil cracks as low as -$8 per barrel, whilst

European cracks remain slightly in the low double digits, prices of

heavy sour crudes are poised to balloon over the upcoming weeks

including Middle Eastern formula prices.

Market Movers

- Crescent Midstream, a US-based midstream operator backed by

Carlyle Group, is reportedly exploring a potential sale after

receiving takeover interest, with the Gulf of Mexico-focused firm

valued at $1.3 billion including debt.

- US oilfield services giant Baker Hughes (NASDAQ:BKR)

landed a

deal with Saudi Aramco that would see it delivering equipment to the

third phase of the Saudi NOC’s gas network expansion.

- Delayed by several years, UK oil major BP (NYSE:BP)

launched

the $6 billion Azeri Central East platform it operates offshore

Azerbaijan, seeking to boost production by 23,000 b/d by year-end.

Tuesday, April 23, 2024

After a string of politics-heavy weeks when the oil markets were

predominantly focused on political risks such as a potential

Israel-Iran war, macroeconomics are back in business, with Brent

dropping marginally lower to $86 per barrel. The markets have

shrugged off the looming threat of Iranian sanctions, believing they

wouldn’t have a material impact on physical flows.

Trafigura Bets Big on Copper Boom. Global

commodity trader Trafigura

believes

increasing demand from EVs, power infrastructure, AI and automation

will add at least 10 million metric tonnes of additional copper

consumption over the next decade, expecting a bull run in the late

2020s.

Equinor Might Feel the Environmentalist Squeeze, Too.

A small group of investors led by the UK-based Sarasin

& Partners

filed a

resolution at Norway’s state oil firm Equinor (NYSE:EQNR)

to ramp up the ambition of its emissions-cutting, even though the

Norwegian state that owns 67% has voted against all previous climate

resolutions.

The US Gulf’s Superport Lacks Commercial Backing.

The

ambitious

plan of Enterprise Product Partners (NYSE:EPD) to

build the first deepwater port in the US Gulf, capable of loading

VLCCs, has been stalled as Chevron and Enbridge both backed out and

stagnating US oil supply makes new capacity less desirable.

Namibia’s Giant Discovery Too Big to Handle.

Portugal’s national oil company Galp Energia (GALP)

is

reportedly

looking to farm out half of its stake in exploration block PEL 83

offshore Namibia, having only recently discovered a

multi-billion-barrel field with its Mopane-1 exploration well.

Jet Fuel Demand Fails to Catch Up with Flights.

As newer generations of passenger aircraft become more

fuel efficient,

the recovery in flight activity will most probably not lead to jet

fuel demand surpassing pre-pandemic levels as the IAE forecasts

kerosene demand to rise to 7.4 million b/d, still a far cry from 7.9

million b/d in 2019.

Global Traders Cash In On Byzantine Sanctions.

Glencore and Trafigura stand to

benefit

from recent UK sanctions on Russian aluminium as they withdrew some

$400 million worth of material from LME warehouses and re-registered

it under a new designation, signing storage deals with warehouses to

get a share of the rent for as long as it's there.

Saudi Arabia Penetrates Even Deeper into China’s

Downstream. Saudi national oil firm Saudi

Aramco (TADAWUL:2222) signed a preliminary agreement to buy

a 10% stake in one of China’s newest refineries, the 400,000 b/d

Hengli Petrochemical.

Back Under Sanctions, Venezuela Flirts with Crypto

Again. PDVSA, the national oil firm of Venezuela, is

looking to hedge against dollar risks by shifting its crude and fuel

oil exports to digital currencies, including the dollar-pegged

cryptocurrency known as Tether.

Slowing Down of Electric Transition Puts EU Targets at

Risk. The European Court of Auditors, the EU’s

auditing service, warned that the bloc’s 2035 ban on fossil cars

would hurt its own industry and aggravate dependencies, suggesting a

policy rethink amidst slower-than-assumed EV growth.

Gulf of Mexico to Hold Second Offshore Wind Auction.

Even though the first Gulf of Mexico offshore wind

tender last August saw only one competitive bid, BOEM is pushing

ahead

with the second lease sale to be held in the fall, offering new

acreage in offshore Louisiana and allowing for the production of

hydrogen.

Everyone Wants a Piece of UAE Gas.

European energy majors TotalEnergies (NYSE:TTE) and

Shell (LON:SHEL) are in

talks to

buy stakes in the next LNG export project of ADNOC, the national oil

company of the UAE, with market rumours suggesting an FID on the

project might come as promptly as next month.

California Vows to Finish Exxon Probe Shortly.

California’s attorney general

promised

to conclude a two-year investigation into US oil major ExxonMobil (NYSE:XOM),

previously subpoenaed, and the oil industry’s role in global plastic

pollution by summer, hinting at a potential lawsuit arising

therefrom.

Canada Objects to Mega-Agriculture Merger.

Canada’s Competition Bureau flagged major competition concerns

around the

proposed

$34 billion merger between top grain traders Bunge (NYSE:BG)

and Glencore-backed Viterra (LON:GLEN), saying it

would harm competition for grain markets in Western Canada.

Tom Kool

Editor, Oilprice.com

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212