|

31 August 2023

By

Jeannine Mancini

Billionaire Charlie Munger Said, 'If

You Mix Raisins With Turds, You Still Have Turds'

– His Insightful Reminder To Be Selective In Your Investments ... And

Your Life

The investment world was at a crossroads in 2000.

The dot-com bubble was in full swing, drawing investors to internet-

and tech-related stocks. Traditional investment wisdom seemed to take

a backseat as the allure of quick gains took center stage.

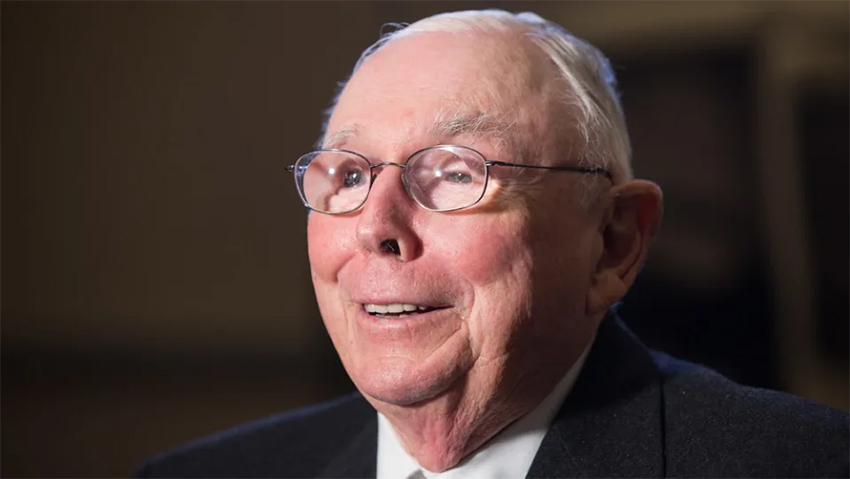

Amid this speculative frenzy, Charlie Munger, legendary investor

Warren Buffett’s esteemed partner, delivered a memorable analogy at

the Berkshire Hathaway Inc. annual meeting.

“If you mix raisins with turds, you still have turds,” Munger said,

cautioning against the perilous practice of blending promising

investments — the raisins — with speculative and irrational ones — the

turds. Even when combined, the flaws inherent in the speculative

assets could outweigh any potential merits, ultimately leading to

unfavorable consequences.

Munger’s analogy is still relevant today, as investors are constantly

bombarded with new investment opportunities, including companies like

Masterworks. The platform allows people to invest in art, which is a

tried-and-true asset class.

Don’t Miss:

Goldman Sachs says: Portfolio(s) with a slice of real assets [like

art] performed even better than the 60/40 over the long run.

Hedge funds intend to snatch all pre-IPO shares of future AI unicorns

before you can. But there is one venture product investing on your

behalf.

In the backdrop of the dot-com bubble, the internet was rapidly

reshaping industries and societies. Even seasoned investors like

Buffett were grappling with the uncertainty and potential disruption

that the new technology could bring. In 2000, the internet remained an

enigma, and its impact on businesses was a subject of concern and

speculation.

During the same year, a child at the Berkshire Hathaway annual meeting

posed a question that encapsulated the growing apprehension about the

internet. The child asked whether the internet would harm companies

like The Washington Post or the Buffalo News, which were part of

Berkshire Hathaway’s investments. Newspapers, traditionally reliant on

print distribution, faced an impending threat from the internet.

Buffett recognized the fundamental challenge the

internet posed to the newspaper industry. For centuries, newspapers

had been the primary source of information and entertainment, with a

business model rooted in printing and distribution. But the internet

was poised to disrupt this centuries-old model by offering content at

incredibly low costs, thereby threatening traditional revenue streams.

Looking to be a part of the next big thing? Explore the opportunities

to invest in early-stage startups and seize the potential for

exponential growth. Click here for a list of startups you can invest

in today.

Buffett acknowledged the potential impact the internet could have on

Berkshire Hathaway’s portfolio companies, noting that some businesses,

like Geico, could be significantly affected. Munger, in his

characteristic straightforward manner, concurred with the child’s

question about the internet’s potential harm. He said they were

concerned about the internet’s impact.

Fast forward to today, and Berkshire Hathaway’s portfolio tells a

different story. Apple Inc. constitutes 40% of Buffett's portfolio.

Buffett’s stance on technology companies has undergone a significant

transformation. He has not been reticent about his admiration for

Apple, referring to the tech giant during Berkshire’s 2023 annual

meeting as “a better business than any we own.” The statement carries

immense weight, considering that Berkshire holds stakes in around four

dozen securities and has acquired roughly five dozen companies over

the years.

The lessons from Buffett and Munger’s experiences in 2000, coupled

with Munger’s memorable analogy, serve as timeless reminders. In a

world where investment opportunities change often and the excitement

of making quick money can be tempting, investors need to be careful

and make wise choices. The principle “mixing raisins with turds, you

still have turds” serves as a broader metaphor applicable to life’s

many choices and decisions.

Just as Berkshire Hathaway adapted to the rise of technology, today’s

investors must balance the allure of innovation with a commitment to

sound investment principles. They should remember that mixing raisins

with turds can still yield undesirable results, highlighting the

importance of critical assessment and a long-term perspective in the

face of change.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212

|