|

December 26, 2023

By Zachary Shahan

Solar Panel Prices Down 30–40% In

2023, US Prices Down 15%

One of the interesting notes in the recently

published US Solar Market Insight report is that the average global

solar module price in the 3rd quarter of 2023 was down 30–40% from the

average global solar module price in the 1st quarter of 2023. This is

primarily due to supply–demand imbalances in China. The US market gets

almost no solar panels from China due to tariffs and the Uyghur Forced

Labor Prevention Act (UFLPA), with those Chinese solar panels

accounting for just 0.1% of US solar module imports. Nonetheless,

those global trends have had notable ripple effects on US solar module

prices, which were down 15% in Q3 2023 compared to Q1 2023.

“However, it’s important to acknowledge the differences in solar

module supply dynamics between the US and the rest of the world. Other

global regions are currently in a state of module oversupply. As China

continues its massive expansion of manufacturing capacity across the

entire solar value chain, there has been significant downward pressure

on global module pricing. The impacts of this oversupply situation

have escalated recently, with reports of spot module prices outside of

the US as low as 14-15 cents/watt,” the report states.

“By contrast, the US market is somewhat insulated from these pricing

dynamics. Less than 0.1% of US module imports this year have come from

China due to a combination of tariffs (anti-dumping and countervailing

duties [AD/CVD], Section 201, and Section 301). Almost 80% of modules

for the utility-scale market come from Southeast Asia. And while

Southeast Asia is generally a low-cost region for module production,

manufacturers are still exposed to the restrictions on polysilicon

sourcing from China due to the Uyghur Forced Labor Prevention Act (UFLPA).

“Consequently, module supply to the US utility-scale sector is still

tighter than other global regions. Demand for modules from top tier 1

manufacturers is high. This has kept US module pricing significantly

above price points in other countries, even without anticircumvention

tariffs (for more on solar component pricing, see Wood Mackenzie’s PV

Pulse). On balance, availability of modules for the US utility-scale

market is still constrained but has improved substantially this year.

Of course, module availability will continue to improve as more

domestic manufacturing comes online.”

What’s surprising and a bit crazy is that the utility-scale solar

power market is having much more trouble now getting other parts.

Solar module supplies have started flowing pretty well, but the

industry has to wait a long time for other types of electrical

equipment. The result, naturally, is also rising prices. “Transformer

availability has become a widespread problem, with wait times

extending past 2 years in some cases. High-voltage circuit breaker

lead times have nearly doubled in the last year to an average of 100

weeks (see Wood Mackenzie’s report H2 2023 US solar PV system

pricing). This has already increased balance of system (BOS) pricing

for utility-scale solar. With no signs of this trend reversing, we

expect electrical equipment availability to be one of several factors

slowing utility-scale solar growth in the next several years.”

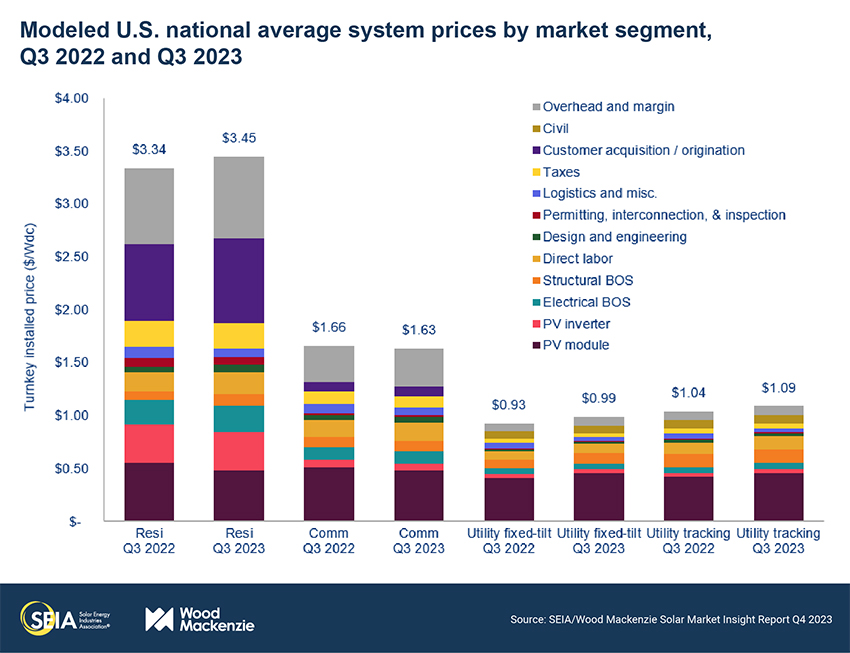

If we break it down by sector (chart above), we see that residential

solar power system pricing was up 3%, commercial solar power system

pricing was down 2%, and utility-scale solar power system pricing was

up 5% (single-axis trackers) to 6% (fixed-tilt systems).

Here are more details on how the pricing for these different segments

was split out by component: “Module prices declined 12% for the

residential and 6% for the commercial segment year-over-year. The

utility segment continues to see elevated module pricing due to the

one-year lag in module procurement reflected in our pricing data. For

distributed solar, the decline in module costs has been offset by an

increase in the balance of equipment as well as soft costs. Across the

four different market segments, labor and engineering costs have

increased anywhere from 5-25%. Equipment component costs have also

been increasing over the last few quarters due to the rise in

inflation. National PV system prices are up across all segments except

for the commercial segment, which witnessed a drop of 2% year over

year.”

We’ll see what happens in Q4 and in 2024, but it’s clear there are a

variety of factors influencing pricing, including differences between

the market segments. It’s hard to know how much will change in the

coming months, as the economic and political situations feels a bit up

in the air and susceptible to strong shifts in the trends. We shall

see.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212

|