|

OIL and Energy Insider

December 05, 2023

Oil Markets Confused and Underwhelmed

by OPEC+ Cuts

Macroeconomic factors continue to weigh on oil prices this week,

despite the insistence of OPEC+ members that the group's production

cuts will tighten the oil market.

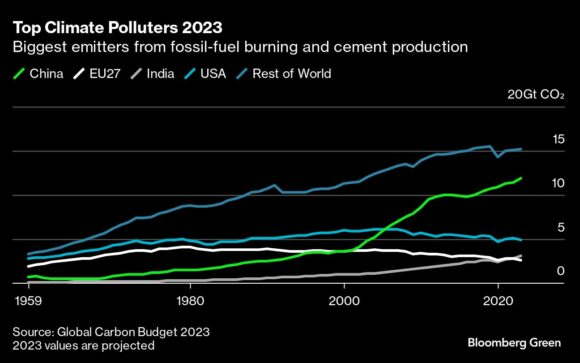

- In a deja vu moment for UN climate change conferences, participating

nations are once again quarreling about whether to demand a full

phase-out of fossil fuels, a claim Saudi Arabia already denounced as

unrealistic.

- Climate change watchers have lashed out at the president of COP28

Sultan al-Jaber for saying the world cannot afford to go “back into

caves” and it needs fossil energy for sustainable development, a claim

they allege contradicts the UN’s own agenda.

- The COP28 summit has so far managed to formalize a

pledge to triple global renewables capacity by the end of this decade,

create a climate disaster fund and cut cooling-related emissions by at

least 68% globally by 2050.

- More than 2,400 delegates at the COP28 summit were representing the

oil, gas and coal industries, almost five times more than at the

previous summit in Glasgow, triggering the ire of environmentalists

that accuse them of lobbying against much-needed measures.

Market Movers

- US midstream major Equitrans Midstream (NYSE:ETRN) is considering selling

the entire business according to Bloomberg, aiming to capitalize on

the upcoming start of the Mountain Valley pipeline.

- Colombia’s national oil firm Ecopetrol (NYSE:EC) will invest $5.8-6.7

billion and produce up to 730,000 boepd in 2024, in line with this

year’s levels though focusing more on energy transition from now on.

- The ownership reconfiguration in

Trinidad and Tobago’s Atlantic LNG facility will see BP’s

(NYSE:BP) share in the project rise to 45%, equalling that of Shell

(LON:SHEL) which previously used to own 54% of the asset.

Tuesday, December 05, 2023

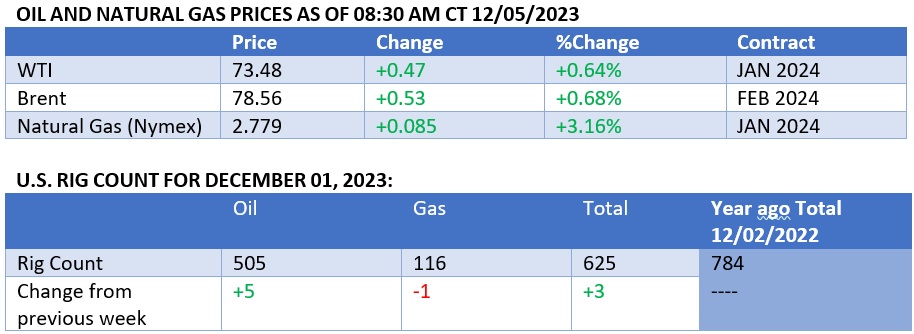

Members of the OPEC+ group continue to insist that the 2024 production

targets allocated last week will have an impact on oil markets, only

to receive lukewarm acknowledgment from market participants. A rebound

in US refining last week is more likely to trigger some bullish

momentum than Saudi Arabia or Russia, with ICE Brent currently trading around

$79 per barrel, although the continuous stream of weak macroeconomic

data limits the upside for now.

COP28 Mulls Fossil Fuel Phase Out. The

second draft of the COP28 final agreement circulated amongst

participants shows the summit is considering calling for an “orderly

and just” phase-out of fossil fuels, though COP27’s call for phasing

out “unabated” fossil fuels might prevail again.

Lula Plays Down Brazil’s OPEC+ Role. Brazilian

President Lula da Silva said the Latin American country will never be

a full

member of OPEC and only strives to have an observer’s role

in the group, alleging that Brazil wants to influence the policy of

the world’s largest oil producers.

Red Sea Becomes Toxic for Israeli Commercial Tankers. In

the most recent escalation

of maritime trade risks, Houthi militias claimed to have attacked two

commercial Israeli-linked vessels in the Red Sea, subsequently also

attacking US warship USS Carney that responded to the vessels’

distress call.

Dozens of COP28 Participants Agree to Nuclear Pledge. 22

nations comprising the US, Canada, France, and even Japan have

committed to triple the world’s nuclear capacity by 2050 compared to

2020 levels, acknowledging the “key role” of nuclear power in reaching

net zero global emissions.

US Vows to Speed Up SPR Replenishments. The

US Department of Energy has announced that

it would speed up the repurchase of 4 million barrels of oil to the

Strategic Petroleum Reserve by February 2024 instead of the upcoming

summer, lifting it from the current 351.6 MMbbls.

India Starts Buying Venezuelan Oil Again. India’s

largest refiner Reliance (BOM:500325) resumed purchases

of Venezuelan crude after a four-year hiatus, taking in several VLCC

cargoes from PDVSA for February delivery at between $7.50 and $8 per

barrel below Dated Brent on a delivered basis.

Japan Calls to Expand Strategic LNG Stocks. Japan’s

power utility companies have called for

an increase in strategic LNG stocks to expand the country’s buffer in

times of disrupted supply, warning of heightened geopolitical risks

amidst conflicts in Ukraine and Palestine.

China Seeks to Cool Down Iron Ore Prices. Iron

ore futures traded on

the Singapore and Dalian Commodity Exchanges have started to diverge

with the former still growing to $133 per metric tonne, with Beijing

announcing they would supervise the price to maintain “stable

operation” of the market.

Nigeria Mulls Revoking Unused Oil Licenses. Nigeria’s

oil regulator is considering revoking

unused and expired oil exploration leases, equivalent to some 60% of

all prospecting licenses comprising 33 auctioned blocks, in a bid to

boost production by managing existing contracts better.

US Majors Defy Calls for Methane Pact. US

oil majors Chevron (NYSE:CVX) and ExxonMobil

(NYSE:XOM) didn’t provide any

financial aid to the global flaring and methane reduction pact

unveiled at Dubai’s COP28 summit, with the former not even signing up

for the program’s charter.

Shipping Rates Start to Reflect European ETS. As

the European Union is set to introduce the

region’s shipping market into its Emission Trading Scheme (ETS),

freight fixtures have started to factor in the costs of emissions into

agreed tanker rates for any vessel with deadweight of 5 kt and above.

India Is Set to Depress Petrochemical Markets. India

will commission two

multi-billion-dollar petrochemical plants in the coming months with Nayara

Energy and Hindustan Petroleum Corp's (BOM:500104)

Barmer complex bringing the country to the much-coveted point of

self-sufficiency, simultaneously aggravating petchem margins.

ERCOT Disputes $12 Billion Price Tag. A

watchdog for Texas’ electric grid said that new rules that require ERCOT

to set aside a new pool of reserves to react quickly in cases of

supply shortfalls have led to $12 billion of additional costs,

limiting power generation during hot summer days when solar had a

preference.

Tom Kool

Editor, Oilprice.com

P.S. Whether you are new to the oil and gas industry or an

energy market veteran, you will regret not signing up for Global

Energy Alert. Oilprice.com's premium

newsletter provides everything from geopolitical analysis

to trading analysis, and all for less

than a cup of coffee per week.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212

|