SIMPLY

WALL

st

Earnings

Release: Here's Why Analysts Cut Their Nikola Corporation (NASDAQ:NKLA)

Price Target To US$2.33

11 May

2023

By

Simply

Wall St

It's shaping up to be a tough period for Nikola

Corporation (NASDAQ:NKLA),

which a week ago released some disappointing quarterly results that

could have a notable impact on how the market views the stock. The

numbers were fairly weak, with sales of US$11m missing analyst

predictions by 10.0%, and (statutory) losses of US$0.31 per share

being slightly larger than what the analysts had expected. Earnings

are an important time for investors, as they can track a company's

performance, look at what the analysts are forecasting for next year,

and see if there's been a change in sentiment towards the company.

We've gathered the most recent statutory forecasts to see whether the

analysts have changed their earnings models, following these results.

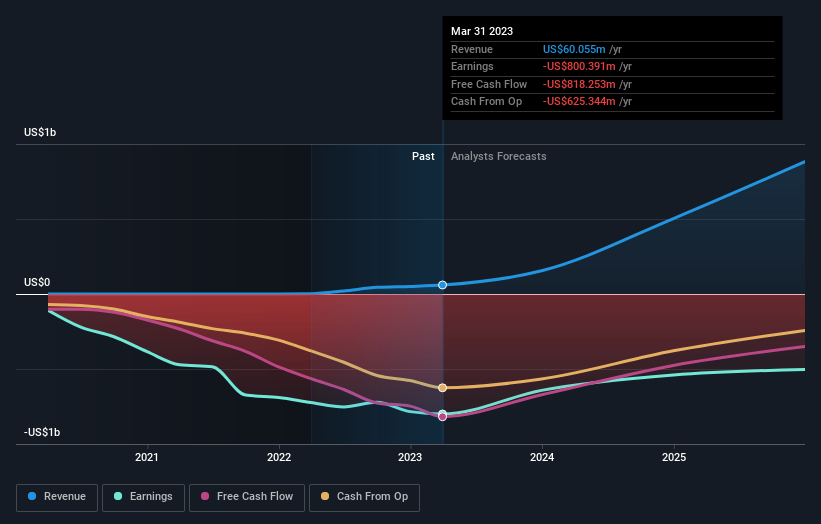

NasdaqGS:NKLA Earnings and Revenue Growth May 11th 2023

Taking into account the latest results, the consensus forecast from

Nikola's seven analysts is for revenues of US$154.5m in 2023, which

would reflect a sizeable 157% improvement in sales compared to the

last 12 months. Losses are supposed to decline, shrinking 16% from

last year to US$0.97. Before this earnings announcement, the analysts

had been modelling revenues of US$151.7m and losses of US$1.08 per

share in 2023. Although the revenue estimates have not really changed

Nikola'sfuture looks a little different to the past, with a cut to the

loss per share forecasts in particular.

Even with the lower forecast losses, the analysts lowered their

valuations, with the average price target falling 26% to US$2.33. It

looks likethe analysts have become less optimistic about the overall

business. The consensus price target is just an average of individual

analyst targets, so - it could be handy to see how wide the range of

underlying estimates is. The most optimistic Nikola analyst has a

price target of US$4.00 per share, while the most pessimistic values

it at US$1.00. So we wouldn't be assigning too much credibility to

analyst price targets in this case, because there are clearly some

widely different views on what kind of performance this business can

generate. As a result it might not be a great idea to make decisions

based on the consensus price target, which is after all just an

average of this wide range of estimates.

One way to get more context on these forecasts is to look at how they

compare to both past performance, and how other companies in the same industry are

performing. The analysts are definitely expecting Nikola's growth to

accelerate, with the forecast 253% annualised growth to the end of

2023 ranking favourably alongside historical growth of 136% per annum

over the past three years. By contrast, our data suggests that other

companies (with analyst coverage) in a similar industry are forecast

to grow their revenue at 4.8% per year. Factoring in the forecast

acceleration in revenue, it's pretty clear that Nikola is expected to

grow much faster than its industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to

their forecasts for a loss next year. Happily, there were no major

changes to revenue forecasts, with the business still expected to grow

faster than the wider industry. Furthermore, the analysts also cut

their price targets, suggesting that the latest news has led to

greater pessimism about the intrinsic value of the business.

Following on from that line of thought, we think that the long-term

prospects of the business are much more relevant than next year's

earnings. At Simply Wall St, we have a full range of analyst estimates

for Nikola going out to 2025, and you can see

them free on our platform here..

Don't forget that there may still be risks. For instance, we've

identified 5

warning signs for Nikola (2 shouldn't be ignored) you

should be aware of.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|