Oil Prices Climb as Bullish

Catalysts Build

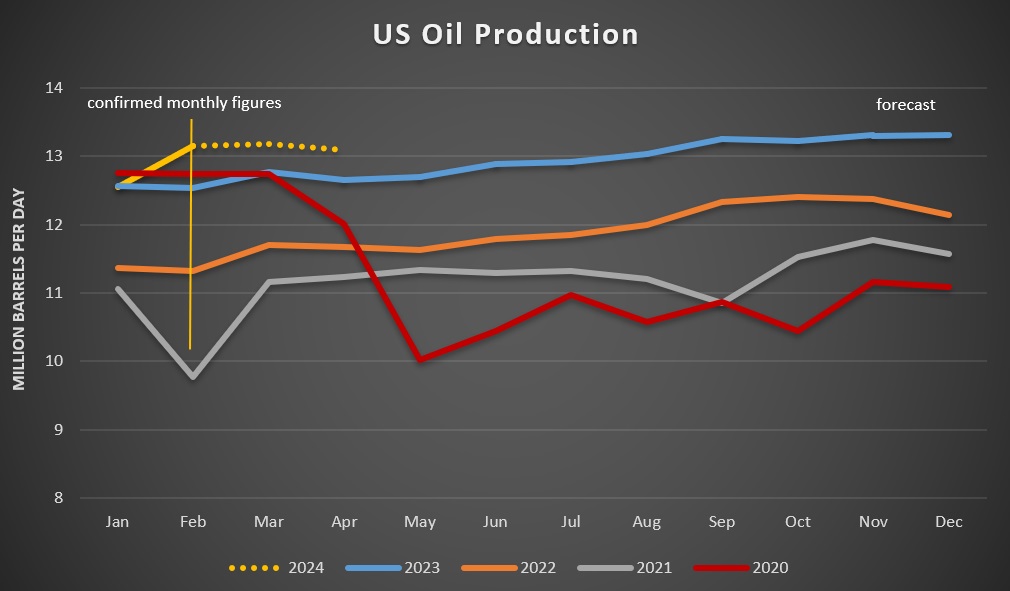

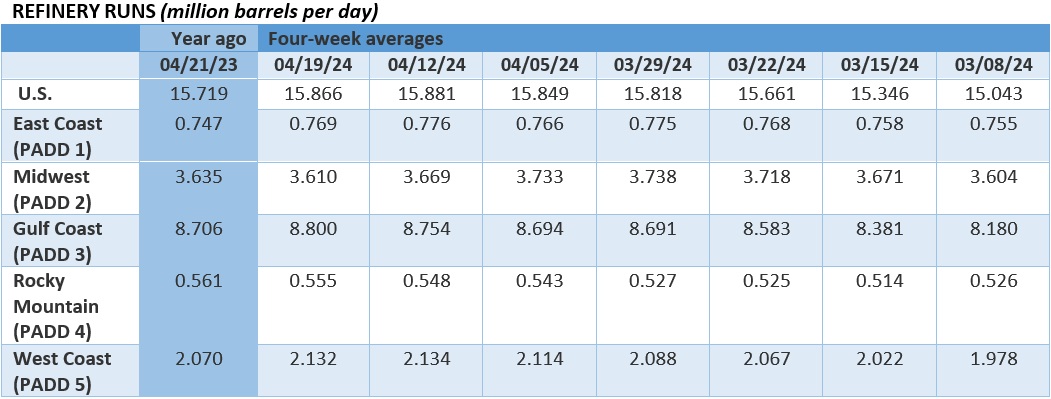

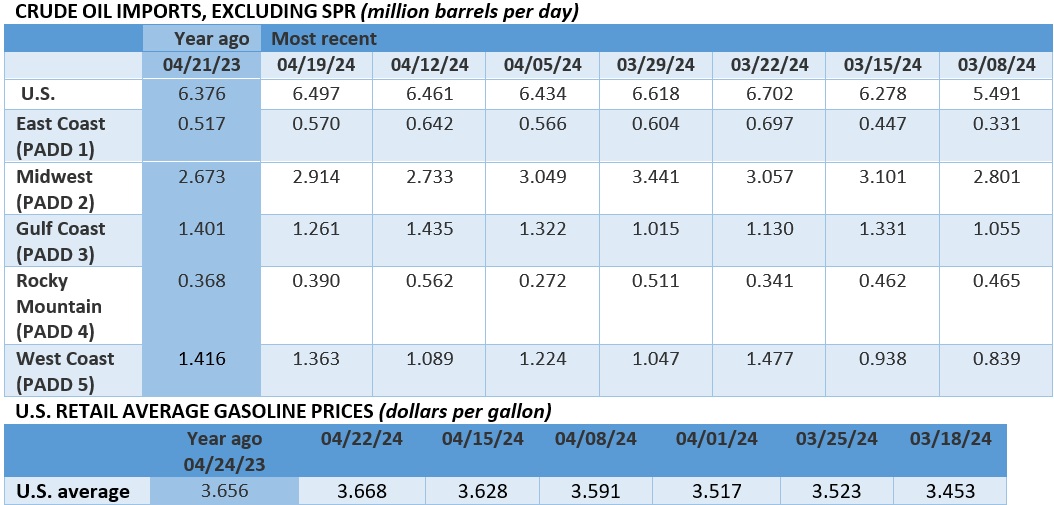

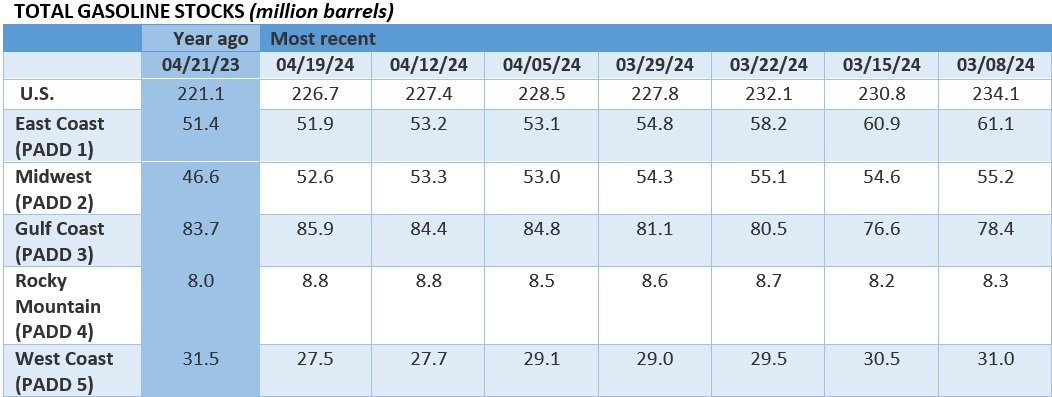

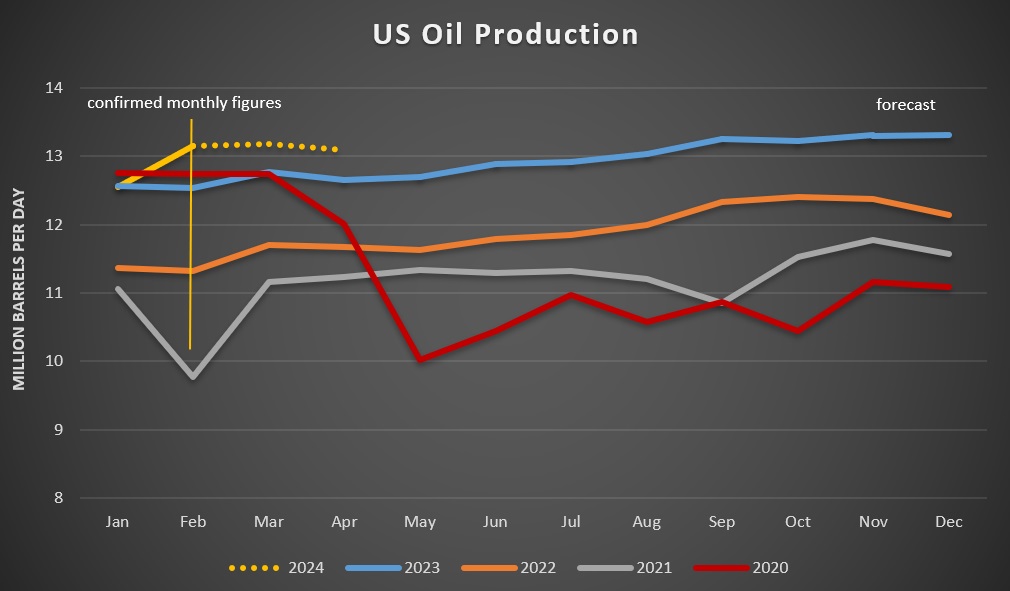

Oil prices are set to post a gain this week as a combination of

inventory declines, a slowdown in U.S. manufacturing, and escalating

tensions in the Middle East boost bullish sentiment.

Friday, April 26th 2024

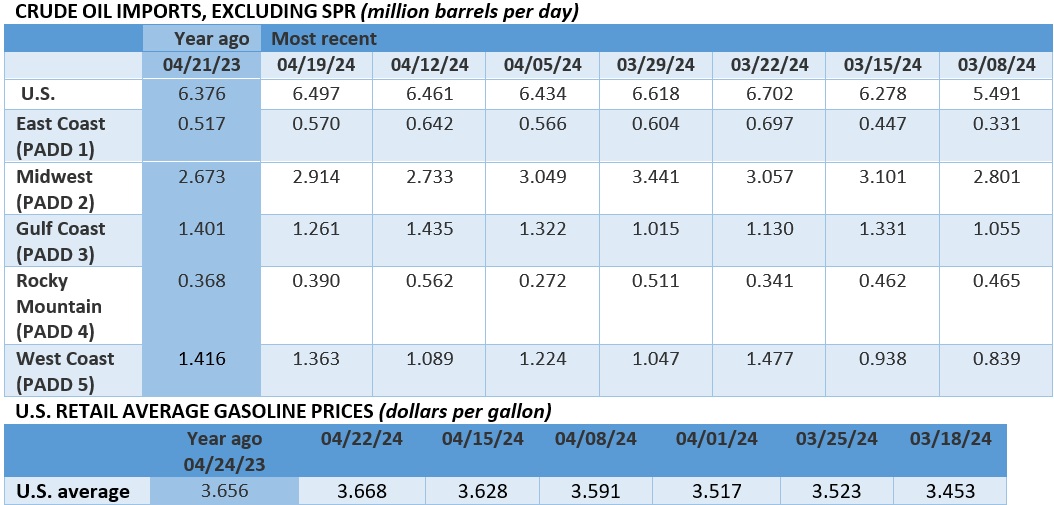

Even if headed towards the first weekly gain since early April, oil

prices have so far failed to break out above the psychologically

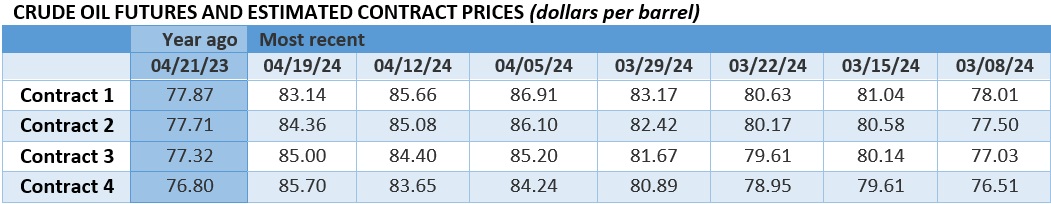

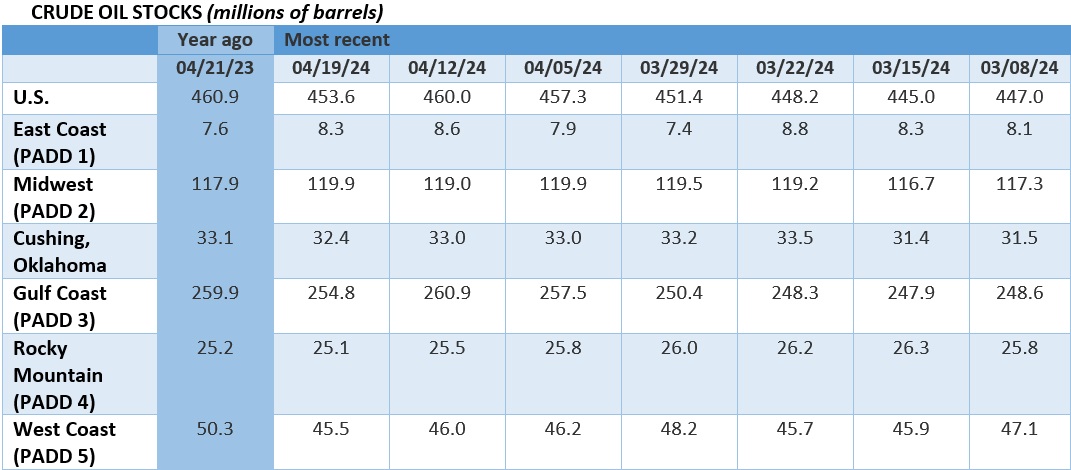

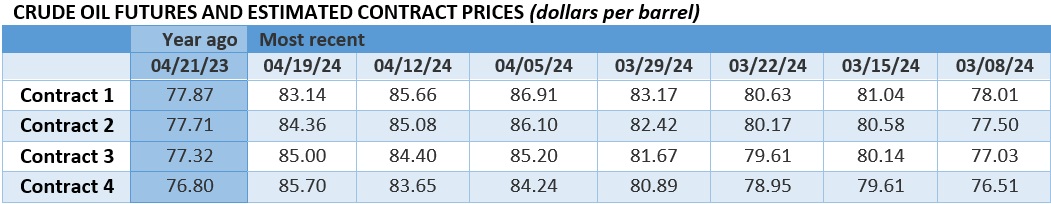

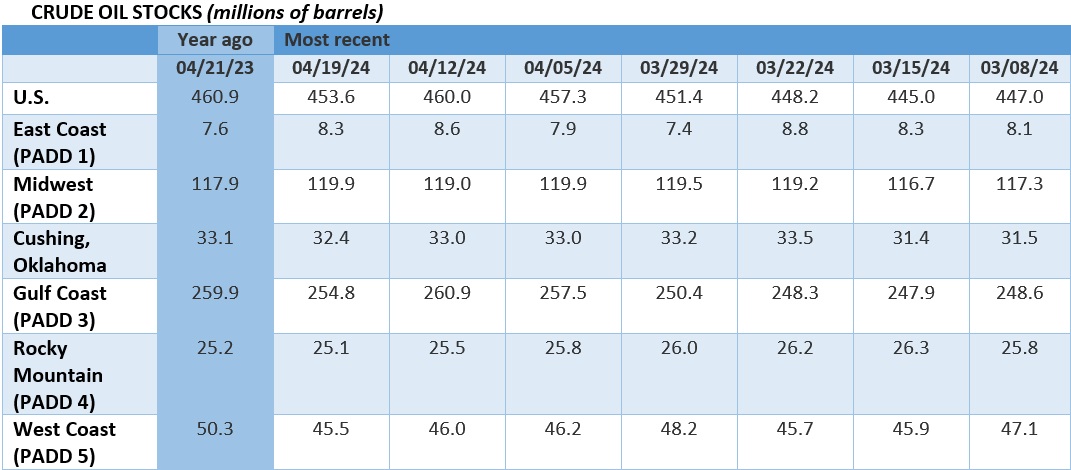

important $90 per barrel mark. A higher-than-expected draw in US

crude inventories, a notable slowdown in US manufacturing that

sparked hopes of a June interest rate cut, and continuing tensions

in the Middle East have added some upside with ICE Brent currently

trading around $89 per barrel.

A Copper Giant Might Be in the Making.

Mining major AngloAmerican (LON:AAL) said it had

received

an all-share buyout proposal from the world’s largest listed miner, BHP

Group (ASX:AX), in a deal that would make the BHP the

world’s leading force in copper. AngloAmerican rejected the first

offer as “highly unattractive”.

Canada Warns of Wildfire Risks for Oil.

The Canadian province of Alberta is

tightening

restrictions on movement as wildfire season started earlier than

usual due to an ongoing drought, only a year after suffering the

worst-ever fires in 2023 that knocked out some 300,000 b/d of oil

production at the time.

TMX Shippers Voice Concerns Ahead of May Launch.

Shippers on Canada’s Trans Mountain Expansion pipeline

indicated

the projected start date of May 1 might not be feasible as some

sections of the pipeline are yet to receive regulatory approval,

even though TMX seeks to receive toll fees already next month.

Iraq Promises to Commit to OPEC+ Supply Discipline.

Following months of overproduction when it overshot its quota by

200,000 b/d in Q1, Iraq is now pledging to cap its oil exports at

3.3 million b/d until the end of the year regardless of the OPEC+

meeting outcome in early June.

LME Seeks to Stymie Sanction Trade Opportunities.

After UK sanctions on Russian metals created loopholes for traders,

resulting in a string of aluminum storage deals in LME warehouses,

the London Metal Exchange

announced

it would step in to halt the lucrative storage deals.

Woodside Climate Plan Gets Voted Down.

Shareholders of Australia’s leading oil producer Woodside

Energy (ASX:WDS)

rejected

the company’s climate plan this week with 58% of the ballot finding

it devoid of ambition, saying its $20 billion fossil fuel project

portfolio and reliance on carbon credits is insufficient.

Egypt Halts All LNG Exports from May.

Struggling to meet its domestic power needs with drastically

declining domestic gas production from the Zohr offshore field,

Egypt has

halted

all LNG exports from May onwards, becoming a net importer for the

first time since 2018.

UK North Sea to See $2.4 Billion Oil Merger.

Italy’s oil major ENI (BIT:ENI)

agreed

to merge its UK oil and gas assets with independent producer

Ithaca Energy (LON:ITH), set to hold a 38.5% stake in the

newly formed company that will aim to become the largest British oil

producer by 2030.

Higher LNG Prices Prompt Asia Buyers’ Rethink.

The rally in Asia’s spot LNG prices to 10.50 per mmBtu in recent

trades, up 25% since the beginning of March on the back of costlier

shipping and Middle East risks, has

prompted

a notable pullback in opportunistic buying from India and China.

China Wants to Take Over India’s Underbelly.

China’s state-controlled oil company Sinopec is pushing for

greater access into the downstream sector of Sri Lanka, a long-time

core market for India, planning to build a major 160,000 b/d

refinery in the Chinese-run port of Hambantota.

Airbus Gets Russia Sanctions Exemption.

The government of Canada has

provided

Airbus with a sanctions waiver to allow it to purchase and use

Russian titanium in its manufacturing after the North American

country’s titanium sanctions jeopardized the utilization of Airbus

aircraft there.

Europe to Ban Russia LNG Re-Exports.

According to media

reports,

the European Commission’s next Russia sanctions package is expected

to introduce restrictions on LNG re-exports from EU ports, shying

away from an outright ban on Russian LNG imports.

Glencore Eyes Nigeria’s Mining Potential.

Global mining major Glencore (LON:GLEN) has

expressed

interest in Nigeria’s untapped mining sector if the government

ensures a stable business climate, emphasizing the African company’s

nickel, cobalt, and zinc potential.

Best

Regards,

Michael Kern

Editor, Oilprice.com

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212