|

11 September 2023

By Jeff St. John

The biomethane boondoggle that could

derail clean hydrogen

If the Treasury Department doesn’t get hydrogen

tax-credit rules right, it could enrich factory farms and fossil fuel

producers rather than boost green hydrogen.

(Edwin Remsberg/VWPics/Universal Images Group via

Getty Images)

Canary Media’s Down to the Wire column tackles

the more complicated challenges of decarbonizing our energy systems.

The Inflation Reduction Act could lay the groundwork for

the mass production of green hydrogen, a vital zero-carbon fuel that

can help clean up industries from shipping to fertilizer production.

Or the law’s hundreds of billions of dollars of green

hydrogen subsidies could be diverted into what critics call a massive

potential greenwashing scheme, powered by fossil fuels and painted

green with manure.

As the U.S. Treasury Department labors over the rules

that will govern the climate law’s hydrogen incentives — known as the

45V tax-credit program — much of the public debate has centered on

defining “green hydrogen,” which is created using water and clean

electricity instead of using fossil gas.

But far less attention has been paid to the “renewable

natural gas” (RNG) industry’s quiet push for the Treasury Department

to allow clean hydrogen tax credits to go to producers who make

hydrogen in the conventional, dirty way and buy the equivalent of a

dodgy carbon offset that enables them to claim their production is

clean.

The RNG industry is pressing the Treasury

Department to adopt a controversial emissions accounting practice that

has its roots in California’s Low-Carbon Fuel Standard, or LCFS. That

scheme, which watchdogs say is already starting to be abused in

California, allows producers of hydrogen and other fuels to cancel out

their emissions by purchasing “carbon-negative” credits from

commercial dairies and livestock operations that capture the

planet-warming methane bubbling out of their manure lagoons.

California’s rules, critics say, are much more effective

at turning factory-farm manure lagoons into subsidy gold mines than

they are at actually reducing the carbon intensity of fuels sold in

the state. In fact, many analyses indicate that they increase, rather

than decrease, greenhouse gas emissions and air pollution.

And if the Treasury Department adopts key facets of

California’s policy as it develops the climate law’s massive hydrogen

subsidy program, it could replicate that outcome at a nationwide

scale. That runs the risk of making 45V “the single greatest waste of

climate money in U.S. policy history,” with the possible exception of

the massive, decades-long subsidization of corn ethanol that has

worsened climate and food crises, according to Danny Cullenward, an

expert in carbon-offsets markets and a research fellow at American

University.

Allowing fossil hydrogen producers to greenwash their

product with manure-derived credits would also undercut the economics

of truly green hydrogen — a fuel that climate researchers agree we

need to produce in large quantities in order to decarbonize key heavy

industries.

The fossil fuel giants and biomethane companies lobbying

in support of California’s approach argue that it demonstrably reduces

emissions by preventing methane, a highly potent greenhouse gas, from

entering the atmosphere. They also claim it makes it financially

feasible for livestock operations to control the massive methane

emissions that result from the factory-farming practice of storing

liquefied manure in massive lagoons.

But environmental groups say that the claimed emission

reductions are based on shoddy accounting and that the government

shouldn’t turn factory-farm pollution into an income stream.

“The purpose of that tax credit is to build out

technology that can deliver clean hydrogen for the future,” said Julie

McNamara, senior energy analyst with the Union of Concerned

Scientists. “I certainly don’t think the intention was to have steam

methane reformers” — the fossil-gas-fueled, highly emitting facilities

that make nearly all hydrogen today — “using paper accounting to

suddenly say it’s clean.”

“What’s worrisome,” she said, is that “these old

assumptions are at risk of being exported across the country.”

The Treasury Department is expected to issue its

guidance on the 45V hydrogen tax credits sometime in October.

How California allows dirty hydrogen to be greenwashed

The reason experts are so alarmed about this practice

possibly making its way into federal law is that they’re already

seeing its consequences unfold under California’s LCFS — the country’s

biggest state-level “clean fuels” program and a model for similar

programs nationwide.

Over the past year, Sasan Saadat, a senior research and

policy analyst for the nonprofit Earthjustice, has tracked multiple

applications from steam methane reformers (SMRs) to the California Air

Resources Board (CARB), the state agency that manages the LCFS,

seeking to claim that their operations are actually removing

greenhouse gases from the atmosphere.

At a high level, the process behind these “book and

claim” transactions works like this: Facilities that use fossil gas to

make hydrogen sign contracts with commercial livestock operations that

capture biogas from their manure lagoons and turn it into biomethane.

The refining is done with machines called methane digesters. Under

LCFS rules, California views these systems as “carbon-negative” and

allows owners of these systems to sell corresponding

“carbon-negative” credits. Hydrogen producers and other fossil-fuel

providers can buy these credits — from factory farms not just in

California but anywhere in North America — and are then able to sell

their fuel as “carbon-free” in California.

A methane digester at a dairy farm in California.

(Scott Strazzante/The San Francisco Chronicle via Getty Images)

The logic is that methane, which is also the

primary ingredient of fossil gas, is a far more potent greenhouse gas

than carbon dioxide in the short term. Even if the methane captured

from manure lagoons is later burned to generate electricity, heat

homes or fuel vehicles, emitting carbon dioxide in the process,

keeping it from entering the atmosphere as methane could be considered

a net positive for the climate. The farms that produce RNG usually

burn it to generate electricity on-site or, more rarely, inject it

into existing fossil-gas pipelines.

But the LCFS credit-accounting structure fails to

grapple with the real-world impacts of the polluting industries that

use it, Saadat said. Fossil-gas hydrogen producers applying for LCFS

credits, such as FirstElement, Iwatani and Shell North America, plan

to keep using fossil gas to produce hydrogen, thereby emitting carbon

dioxide as well as other pollutants into the air of the communities

they’re in, and simply claim the credits from far-off methane

digesters to capture clean-fuel subsidies from the state.

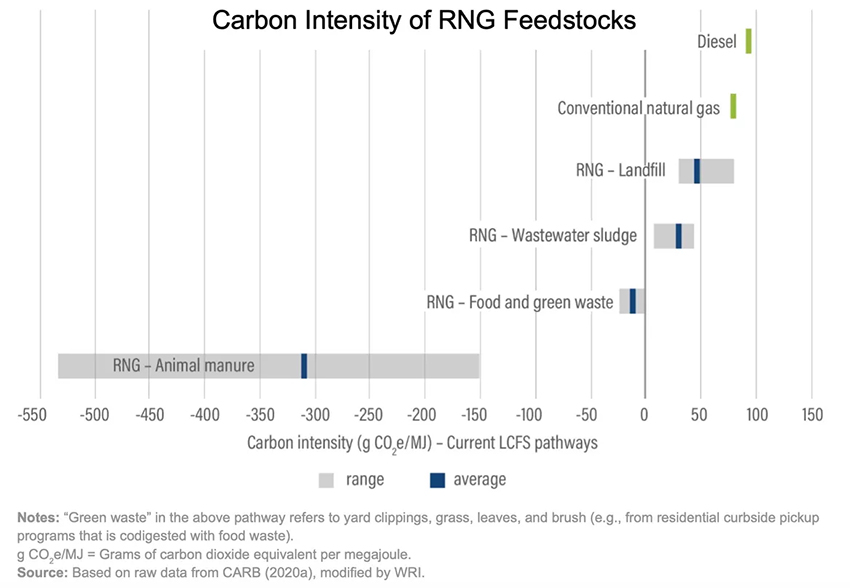

Not only does this eliminate on-paper emissions for

producers of fossil-based hydrogen, but under LCFS accounting rules it

can actually be considered carbon-negative, he noted — akin to

directly removing carbon from the atmosphere. The LCFS program treats

RNG from concentrated livestock farming as having a far greater

greenhouse-gas-reduction impact than any other source of the fuel,

including landfills, wastewater treatment plants and food waste.

Saadat and other climate advocates say CARB’s

accounting on RNG carbon intensity is absurdly misguided.

“Nowhere in the chain of producing this are we drawing carbon

out of the atmosphere and burying it in the ground,” Saadat said.

“But this is being treated as this super-powerful carbon

sequestration, on the premise that nothing else could control this

methane.”

Hydrogen producers don’t even have to prove that the methane

digesters they’re funding are “additional,” meaning farms built them

because of the hydrogen producers’ investment, he said. One

application for LCFS credits from hydrogen producer FirstElement is

with the Deer Run Dairy Digester in Kewaunee, Wisconsin, which has

been running since 2013, he noted.

Even if these hydrogen producers were spurring the construction

of new manure-lagoon methane digesters, Earthjustice and many other

environmental groups question the rationale of rewarding those

investments with special treatment. They want regulators to penalize

livestock operators for the planet-warming emissions their manure

lagoons create and push them to curb those emissions.

While overall U.S. methane emissions have declined since 1990,

EPA data indicates that agricultural-sector methane emissions have

risen dramatically. The primary culprit is the factory-farming

practice of liquefying manure and storing it in lagoons, ponds or pits

where it decomposes into methane in the absence of oxygen, rather than

using more traditional manure-management methods that emit little to

no methane.

Manure lagoons have “become the preferred and cheapest way to

manage waste,” said Tyler Lobdell, a staff attorney for Food & Water

Watch.

It’s also a lucrative way to manage waste, thanks to

California’s LCFS. The value of the program’s incentives has enabled

manure-digester investments that would otherwise fail to make economic

sense, according to analysis from Aaron Smith, an economics professor

at the University of California, Davis.

Without the revenue from selling LCFS credits, biomethane from

manure-lagoon digesters would cost about 10 times more to produce than

it could earn from being sold at fossil-gas wholesale prices, he

noted. In that sense, LCFS incentives put dairy operators in the

position of “farming methane rather than milk,” he wrote.

But despite years of demands from environmental groups to

impose regulations on livestock and dairy farms to reduce the

incentives for this practice, in California CARB is currently planning

to allow the existing “carbon-negative” system to persist well past

2030.

This could serve as a perverse incentive for livestock

operators to manage their manure in ways that increase their methane

emissions in order to earn more money from capturing them, Cullenward

said. “There’s credible evidence that we’re getting there on the

basis of LCFS alone,” he said, and “there’s no doubt that the 45V

credit” would dramatically increase that incentive — if the Treasury

Department decides to adopt California’s policies.

The pressure to bring “book and claim” to federal clean

hydrogen policy

California’s LCFS policy has spurred a “brown gold rush” of

capital chasing the value of methane captured from manure lagoons.

Even so, the program’s ramifications for hydrogen production are

limited by its relatively small scale; it only applies to fuels sold

in California for road transportation.

But if the program’s approach were scaled up to a national

level, the ramifications would be enormous. The U.S. as a whole has

roughly 10 million metric tons of hydrogen production capacity, the

vast majority made by SMR plants using fossil gas. And there’s a

growing amount of biomethane that could be used to offset that

hydrogen production: Research firm Wood Mackenzie forecasts that U.S.

biomethane production could see a tenfold increase by 2050.

GET CAUGHT UP

a conceptual image of hydrogen molecules against a blue

background

Will a planned ‘blue’ hydrogen hub in Appalachia help or hurt

the climate?

Kathiann Kowalski

A dispatch from the dawn of the green hydrogen era

Eric Wesoff

A profitable fuel-cell company finally emerges amid

industrywide losses

Eric Wesoff

Meanwhile, green hydrogen barely exists — just 1 percent of

hydrogen in the U.S. is made with clean electricity and water through

use of electrolyzers. The Inflation Reduction Act’s subsidies offer

the fledgling industry a real chance at rapidly changing that picture,

but only if the money goes to companies producing bona fide green

hydrogen.

That’s why there’s a loud and ongoing public debate around

what, precisely, the 45V program should treat as green hydrogen. It’s

been the subject of major political ad campaigns, the cause of

disputes between Democrats in the U.S. Senate, and the source of a

growing rift between clean energy advocates.

But all of it could be rendered more or less moot if Treasury

decides to port over California’s LCFS structure, Cullenward warned.

In that scenario, fossil-based hydrogen plants could theoretically

contract with livestock methane-digester projects anywhere in North

America to achieve, on paper, a carbon-negative rating.

Today, making clean hydrogen via electrolysis costs about $5 to

$6 per kilogram, compared to about $1 to $2 per kilogram for hydrogen

made from fossil gas. If fossil-gas hydrogen producers can qualify for

the same $3-per-kilogram tax credits offered to the cleanest hydrogen

under 45V, it would shut down the true green hydrogen economy before

it even begins.

“If you allow RNG to come into the market” and open the door to

“traditional hydrogen with these junk offsets,” the result would be

to “blow up the competitiveness of electrolytic green hydrogen,”

Cullenward said. “The only question would be how many digesters can

you slap together.”

But that disastrous outcome for green hydrogen would create a

tremendous opportunity for the renewable gas industry, which could

explain why its members are pushing for that outcome.

RNG industry players haven’t yet explicitly stated that they

intend to go after federal green hydrogen tax credits in this way. But

many of these companies are actively lobbying the Treasury Department

and the U.S. Department of Energy, which is developing a methodology

for measuring the greenhouse-gas impact of various hydrogen production

pathways, to embed California’s LCFS policies in the 45V tax-credit

rules.

In a November 2022 letter to the DOE, the Coalition for

Renewable Natural Gas trade group advocated for “market-based

instruments” like those used in California’s LCFS to be included in

the federal government’s rules for determining the greenhouse-gas

impacts of hydrogen production.

Allowing existing hydrogen producers to claim credits from

methane digesters that feed their gas into fossil-gas pipelines will

“allow the widespread, distributed buildout of renewable resources

utilizing common energy delivery infrastructure which already exists,”

the letter stated, “so that first-movers can successfully purchase

clean energy without physical limitations.”

Sam Wade, the coalition’s director of public policy, told

Canary Media in an email, “Book and claim is a proven accounting

method that allows upstream sources of clean power and gas to be built

and that supply matched to the relevant buyers,” including hydrogen

production facilities.

Wade, who spent four years overseeing the LCFS program as head

of CARB’s Transportation Fuels branch before joining the coalition in

2019, said that alternative forms of biomethane accounting, by

contrast, “would preclude most bioenergy-to-hydrogen projects from

access to the tax credit, constrain RNG project development, and thus

delay significant methane abatement of organic waste emissions.”

Similar views were echoed in comments to the Treasury

Department’s 45V rulemaking proceeding from producers of RNG and

fossil fuels including hydrogen and industrial gas producer Air

Liquide, oil-refining giant Valero and the U.S. unit of Dutch oil

giant Shell, as compiled by environmental nonprofit Friends of the

Earth.

Many major oil and energy companies have also recently made

large investments in biomethane production. In the past year,

U.K.-based oil major bp acquired U.S. RNG producer Archaea for $4.1

billion, Shell bought the Danish company Nature Energy for nearly $2

billion, and Florida-based energy company NextEra purchased $1.1

billion in RNG assets from U.S.-based Energy Power Partners.

The industry’s lobbying efforts have a shot at success in part

because of language in the Inflation Reduction Act itself.

The law requires the Treasury Department to use the “GREET

model” — a methodology developed by DOE’s Argonne National Laboratory

— or a “successor model” to GREET to determine the lifecycle

greenhouse gas emissions of hydrogen production. The GREET model is

used in both EPA’s Renewable Fuel Standard and CARB’s LCFS, and it

provides the quantitative justification for treating dirty hydrogen

offset by manure-digester credits as if it’s clean.

Cullenward said the IRA’s reliance on the GREET model “as an

acceptable way to calculate lifecycle emissions” is problematic. “I

expect industry is already saying, ‘Hey, Treasury, California says

it’s OK.’”

That observation is backed up by a number of comments from

biofuels and oil and gas companies to the Treasury Department citing

California’s LCFS as an appropriate model for how it should implement

greenhouse gas accounting for the 45V tax credit. Several oil

companies and biomethane trade groups have also asked the Treasury

Department to lock in existing GREET model methodologies for the 45V

tax credit and bar any changes derived from updated models.

McNamara agreed that the law’s language around this model

raises “some concern, if Treasury isn’t challenged, that some of

these assumptions will just be ported over” from California’s LCFS to

the federal 45V tax-credit program.

The case for and against manure-to-biomethane as a climate

solution

Proponents of manure methane digesters point to longstanding

policies in the U.S. and Europe that consider them an important

contributor to combating climate change that dairies and livestock

operations couldn’t afford without incentives.

“We believe biogas is renewable because the feedstocks that

biogas are made from are infinite and plentiful in their supply,”

Patrick Serfass, executive director of the American Biogas Council and

former vice president for the National Hydrogen Association, said in

an interview. “Therefore, hydrogen made from biogas should be

considered clean.”

But a host of analysts have questioned the validity of

California’s LCFS approach — and the generous treatment of livestock

methane in general. If one accounts for methane that leaks from

digesters and from the fossil-gas pipelines it can be injected into,

that can erase many of the benefits ascribed to capturing the gas.

So might accounting for the emissions associated with producing

manure, such as transporting and feeding animals or the “enteric”

emissions from cow burps, which are excluded from LCFS calculations.

Critics have also highlighted multiple instances of CARB

“double-counting” the emissions reductions from livestock

methane-capture operations to meet multiple climate targets. They’ve

also consistently challenged the LCFS program’s lack of rules to

require that the money paid by carbon-emitting fuel producers be tied

to actually building new methane digesters — challenges that CARB has

consistently rejected.

Serfass argued that the economics of livestock operations

prevent farmers from engaging in more expensive manure-management

practices. He also pushed back against the proposition that regulators

should penalize livestock operators for methane emissions rather than

paying them to abate the emissions.

“If in some future policy, all the manure lagoons in California

were required to capture their emissions,” he said, it “would rocket

the price of milk and the price of beef. Do Americans want that?”

But Jeremy Martin, senior scientist and director of fuels

policy at the Union of Concerned Scientists, said that paying

livestock operators to reduce methane emissions from existing manure

lagoons needs to be a “transitional strategy” rather than a

“permanent entitlement.”

“It doesn’t make sense to make pollution generation a major

revenue stream” for dairies and livestock operations, he said. “Then

we’ve created a system where we have to continue to pay them to not

pollute, otherwise the whole system collapses.”

How to keep California policy from going nationwide

But the Inflation Reduction Act’s hydrogen tax-credit program —

which if done right could help decarbonize some of the

hardest-to-abate industries — does not have to become a boondoggle.

The Union of Concerned Scientists and several other like-minded

organizations have laid out a number of steps the Treasury Department

can take to avoid that outcome.

McNamara summarized the key steps in a May article. First, the

45V program should not allow carbon-negative accounting for biomethane,

in contrast to current LCFS accounting rules. Second, it shouldn’t

allow book-and-claim accounting to mask the real emissions of

fossil-fueled hydrogen production, she wrote.

To embed these principles in how the 45V program works, the

Treasury Department will need to take a fresh approach to the GREET

model, McNamara told Canary Media.

“The statute doesn’t say it has to use GREET — it says GREET or

a successor model,” she emphasized.

That gives the Treasury Department options. One would be to

retain the GREET model’s analytical framework but update its input

assumptions, which critics say are undercounting the greenhouse-gas

impacts of the oil and gas industries today, to better represent the

real-world implications of what it’s modeling.

The GREET model will also need retooling to manage the broader

complexities of measuring the greenhouse gas emissions of hydrogen

production, many commenters to the Treasury Department have noted.

For example, the Institute for Policy Integrity at the New York

University School of Law has asked the Treasury Department to work

quickly with DOE to develop a successor model that can accurately

assess the “marginal emissions” impact of electrolyzers using a mix

of clean and dirty grid power.

It’s also important to remember that policy preferences play a

key role in how technical models like GREET are put to use. Critics of

CARB’s LCFS program have highlighted that its current generous

treatment of livestock methane digesters is based on changes made in

2018 to encourage more investment in reducing emissions from

California’s dairy industry.

The Treasury Department has its own latitude to issue guidance

that does not risk undermining the Inflation Reduction Act’s goal of

creating a clean and sustainable hydrogen industry, McNamara said.

“One of the reasons there’s so much interest in getting these

implementation criteria right,” she said, is that, “as California has

shown with LCFS, once something is implemented, it’s incredibly hard

to change it.”

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212

|