|

January 12, 2024

By

Jeff St. John

Tax-credit rules leave key ‘blue hydrogen’ issues unanswered

Environmental watchdogs worry the Biden

administration’s proposed rules for hydrogen tax credits may allow

fossil gas and biogas to pollute at taxpayer expense.

(Julian Spector/Binh Nguyen/Canary Media)

The Biden administration’s newly proposed

hydrogen tax-credit rules aim to enforce strict carbon emissions

limits on companies making hydrogen from carbon-free electricity —

so-called “green hydrogen.”

But its plans for policing the emissions from hydrogen made from

fossil gas — in particular, so-called “blue hydrogen” — aren’t as

clear. That has environmental watchdogs worried.

“We also need to be paying close attention to the blue hydrogen side

of the equation,” said Morgan Rote, director of U.S. climate policy at

the nonprofit Environmental Defense Fund.

“Blue hydrogen” is the term for hydrogen that’s made from fossil gas,

but in a way that prevents the resulting carbon emissions from

entering the atmosphere. At present, very little blue hydrogen

actually exists — most of the roughly 10 million metric tons of

hydrogen made in the U.S. every year is “gray hydrogen,” which is

produced using fossil gas without capturing emissions.

The Inflation Reduction Act’s “clean” hydrogen subsidy program, known

as 45V for its section of the tax code, is technology-neutral: As long

as a project can prove its emissions are below certain thresholds set

in the law, it’s eligible. But multiple analyses have concluded that

the government’s method for vetting the carbon-intensity of hydrogen

projects is at risk of undercounting blue-hydrogen emissions. That

could allow massive polluting blue-hydrogen facilities to receive

lucrative federal subsidies that are intended to kick-start production

of truly carbon-free green hydrogen, advocates warn.

Plenty of blue-hydrogen projects may be trying to prove that they meet

this emissions criteria in the years to come.

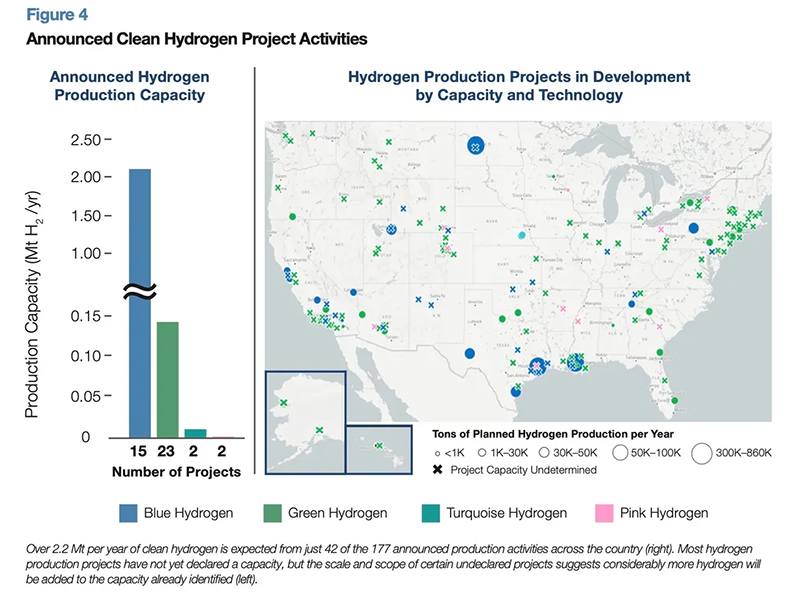

A February report from the Energy Futures Initiative, a nonprofit

research group run by former Energy Secretary Ernest Moniz, found that

proposed blue-hydrogen projects account for 95 percent of total U.S.

low- and zero-hydrogen production capacity that’s now planned. While

small in number, the sheer scale of these projects eclipses the more

numerous green-hydrogen projects in the works.

(Energy Futures Initiative)

Blue hydrogen is also a big part of five of the

seven hydrogen hubs that in October won preliminary approval to

receive up to a total of $7 billion in federal grant funding from the

2021 Bipartisan Infrastructure Law. The long-term economic viability

of these hubs may depend on their access to 45V tax credits. That’s

likely to encourage the companies and politicians involved to pressure

the Treasury Department to craft its rules in a way that allows blue

hydrogen to secure them.

Proponents of blue hydrogen argue that the U.S. can’t scale up its

supply of low- and zero-carbon hydrogen — a fuel seen as potentially

crucial to decarbonizing sectors like heavy industry — unless it

embraces their technology. They also argue that the approach can

result in genuinely “clean” hydrogen, with some going as far as to

claim their fuel is “carbon-negative.”

But environmental groups are skeptical — and they’re asking the

Treasury Department to keep a close eye on blue hydrogen as it fields

public comments in advance of issuing a final rule expected later this

year.

Why blue hydrogen may not be so clean

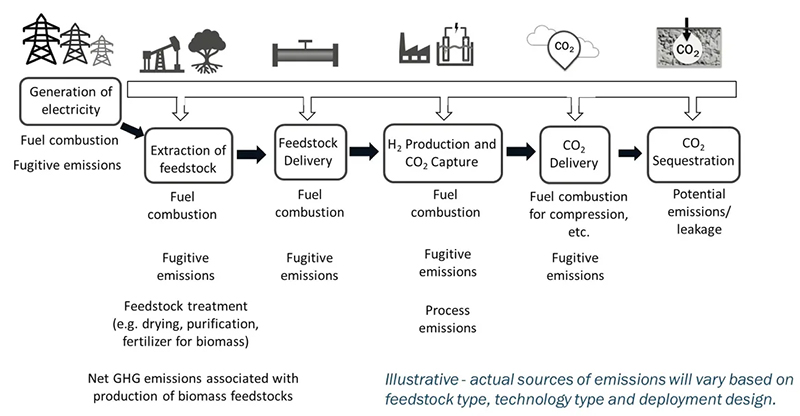

One major question is how Treasury will require blue-hydrogen

producers to account for methane leaks in the “life-cycle emissions”

of the fossil gas they use.

Methane is a relatively short-lived but powerful greenhouse gas, with

more than 80 times the global warming impact of carbon dioxide over a

20-year period.

Leaks can happen at fossil gas wells and through pipelines, compressor

stations and storage facilities to where it’s delivered. Under

Treasury’s proposed “well-to-gate” rules, hydrogen producers will

need to account for “upstream” leakage that occurs before the gas

reaches their facilities, as well as any methane that escapes at the

facilities themselves.

(Department of Energy)

The Inflation Reduction Act requires the Treasury

Department to use what’s called the “Greet model” to determine these

factors. The 45VH2-Greet model, an updated version of the model

designed for the 45V tax credits, assumes an upstream methane leak

rate of 0.9 percent.

That’s well below the 2.3 percent national average leakage rate

established by independent empirical studies, said Tianyi Sun, a

climate scientist with the Environmental Defense Fund. In some parts

of the country, such as the Permian Basin, leakage rates can be as

high as 9 percent.

That’s a big problem, because a blue-hydrogen project using fossil gas

delivered over an especially leaky network could be more harmful from

a global-warming perspective than simply burning fossil gas, according

to studies from EDF and other nonprofits and academic institutions.

The Greet model is updated annually, which provides the opportunity to

recalibrate its leakage rates to better reflect reality, EDF’s Rote

said. “We are doing a deep dive to understand why the Greet number is

what it is.”

Another major variable is how much carbon dioxide blue-hydrogen

facilities can actually capture and store underground. Carbon capture

and storage (CCS) is one way to prevent the climate impacts of burning

fossil fuels, but despite decades of effort and billions of dollars

spent, most of the CCS projects in the world have failed to achieve

the high levels of capture and storage required to make them a climate

solution.

DOE has set a target for blue-hydrogen projects seeking 45V incentives

to capture 94.5 percent of the carbon emissions they generate. But

none of the handful of blue-hydrogen projects that have been built so

far have been able to achieve such a high level, Sun said.

“There is a gap between projections of the effectiveness of carbon

capture and the reality we’re dealing with today,” she said. “They’re

often presuming 90 percent or even above 95 percent. But in reality,

we’re talking about 60 percent that has been demonstrated

commercially,” a finding backed up by reviews of existing steam

methane reformation carbon-capture projects from the Institute for

Energy Economics and Financial Analysis.

Just how the Treasury Department will require blue-hydrogen producers

to track, report and verify their carbon capture rates is not yet

clear.

Nor is it clear how the department will handle a broader problem for

green and blue hydrogen production alike, she said: the risk of

hydrogen leaking into the atmosphere.

“Hydrogen emissions are often completely omitted under life-cycle

assessment frameworks,” including the Greet model, Sun said. But

hydrogen, despite not being a direct greenhouse gas, triggers chemical

reactions that increase the amounts of other greenhouse gases. These

effects cause hydrogen to have 37 times more global-warming impact

than carbon dioxide over the first 20 years after it’s released,

according to recent research. EDF research shows that even moderate

amounts of leakage could significantly erode the climate benefits of

using clean hydrogen — although other groups have highlighted that

hydrogen production with low leakage rates will be more beneficial to

the climate than not adopting it.

Hydrogen leakage is something to worry about across the production,

transport and usage chain, Sun said. But “for blue hydrogen in

particular, if both hydrogen and methane emissions are high, hydrogen

can be worse for the climate in the short term than the fossil fuel

systems it’s replacing,” she said.

The uncertain math for blue hydrogen to earn 45V tax credits

While environmental groups are worried about 45V tax-credit rules that

could subsidize polluting blue hydrogen, hydrogen industry groups are

worried about what they see as overly strict rules that could prevent

effective blue-hydrogen projects from earning the most lucrative top

tiers of the credit.

Sound projects “that can garner higher credits should be allowed” if

their emissions are low enough to deserve it, said Frank Wolak, CEO of

the Fuel Cell and Hydrogen Energy Association. “That’s why we have

the step function of the tiers — to try to challenge people to do

better.”

One way blue-hydrogen producers could reduce their emissions impact is

by using “responsibly sourced natural gas” — a term for fossil gas

that third-party analysis has shown to have lower leakage rates. In

some cases, he said, responsibly sourced gas could bear a life-cycle

emissions rate below the Greet model’s 0.9 percent assumption.

“We haven’t formed a position on the embedded Greet model, whether it

sets rates too low or too high,” he said. “But we shouldn’t

discourage people from applying lower leakage rates if they can prove

their responsibly sourced gas leads to” achieving them.

As for carbon-capture rates at blue-hydrogen facilities, “we’ll have

to see project developers put out the data,” he said. “My sense is

that the [carbon capture and storage] community…would not be going out

and looking to do blue-hydrogen projects if they could not achieve

those carbon-capture rates” needed to go after the highest tier of 45V

credits.

Get Caught Up

an old-fashioned alarm silver clock with bells on top sits on a pile

of US $100 bills

The new hydrogen tax credits could revolutionize how clean energy is

counted

+ more stories

Subscribe to our newsletter

Sign up to get Canary's daily newsletter and stay on top of our latest

headlines.

Your email

By signing up you agree to our User Agreement and Privacy Policy &

Cookie Statement

But even projects that do source fossil gas from the least leak-prone

areas and capture high percentages of their carbon dioxide emissions

may be hard-pressed to access the most lucrative tiers of the 45V tax

credit.

According to an analysis by think tank RMI, even steam methane

reforming plants that capture 90 percent of the carbon dioxide they

emit and source fossil gas with very low upstream methane leakage

rates of 0.2 percent would emit more than 2 kilograms of carbon

dioxide equivalent for every kilogram of hydrogen they produce. That

level of emissions would limit them to receiving only one-quarter of

the highest credit, or 75 cents per kilogram of hydrogen. (Canary

Media is an independent affiliate of RMI.)

But the 45V credit isn’t the only subsidy blue-hydrogen projects can

access. The Inflation Reduction Act also boosted an existing credit

for carbon-capture projects, known as 45Q, that offers up to $85 per

metric ton of carbon captured from point-source emitters, including

steam methane reformers.

Projects can’t claim both 45V and 45Q credits, forcing hydrogen

producers to choose one or the other. But the 45Q tax credit doesn’t

require steam methane reformers to measure the emissions-intensity of

the hydrogen they produce, only the tons of carbon they capture,

making it far simpler to implement.

A growing number of industry analysts are predicting that

blue-hydrogen producers will seek the 45Q tax credit instead of

undertaking the uncertain emissions accounting necessary to claim 45V.

And those producers would not necessarily be barred from selling the

hydrogen they produce as “clean.” The Bipartisan Infrastructure Law

ordered DOE to develop a Clean Hydrogen Production Standard to guide

the definition of clean hydrogen. Under that definition, any hydrogen

produced with 4 kilograms or less of carbon dioxide equivalent per

kilogram of hydrogen is considered clean — a target that steam methane

reformers could reach without achieving the highest rates of carbon

capture and using fossil gas from regions with higher methane leakage

rates.

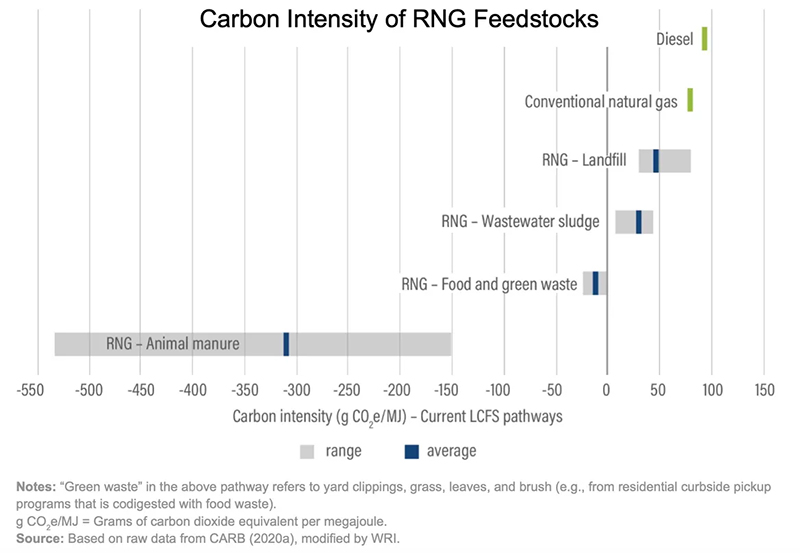

The problem of “renewable natural gas” for hydrogen production

But there’s another way for blue-hydrogen producers to reduce their

on-paper carbon emissions-intensity to a low enough level to achieve

the highest tier of the 45V tax credit, Rote said.

One of the most concerning loopholes involves using credits for

“renewable natural gas” — methane captured from rotting organic

material in landfills, livestock farm manure lagoons or other sources,

also known as biomethane — as a means of “erasing” the real-world

carbon emissions caused by converting fossil gas into hydrogen and

carbon dioxide.

This kind of emissions accounting is allowed by California’s Low

Carbon Fuel Standard, the most widely used renewable fuel standard in

the country. Under the state’s existing rules, methane captured from

livestock manure lagoons and burned for energy is counted not just as

carbon-neutral, but carbon-negative in its global-warming impacts.

What’s more, the state’s standard offers livestock farms far greater

carbon-negative ratings than other sources of RNG, such as landfills,

food waste and wastewater treatment plants.

(World

Resources Institute)

Environmental groups have decried

this practice for years, calling it a perverse incentive for the

state’s powerful dairy industry to expand harmful factory-farming

practices. They argue that methane from livestock operations should

instead be regulated as a global-warming threat by penalizing

operators that fail to limit emissions — not rewarded as a monetizable

resource that fossil fuel providers can purchase to offset their

carbon emissions.

Since the creation of the 45V tax credit, these groups, and some

lawmakers in Congress, have urged the Biden administration to prohibit

similar “book-and-claim” accounting methods, which allow hydrogen

producers to sign contracts with RNG production in another part of the

country to offset the fossil gas they’re using to make hydrogen, from

eligibility for the subsidies. Failing to do so, they warned, could

allow owners of polluting steam methane reformers to claim that they

actually emit less carbon than green hydrogen projects using

carbon-free electricity.

Treasury’s guidance does contain some provisions for RNG to be used to

make hydrogen that can earn 45V tax credits. But the guidance also

lays out some important guardrails against the kind of accounting that

California’s Low Carbon Fuel Standard program allows, said Julie

McNamara, senior energy analyst with the Union of Concerned

Scientists.

First, the guidance only explicitly allows one particular use of RNG,

she said: using RNG that’s directly transported from landfills to

hydrogen production sites. Other methods of using it may be permitted

later, but only after further study.

The guidance also explicitly bars existing fossil-gas-fueled hydrogen

production from claiming that it has undergone a “facility

modification” that would allow it to claim the tax credit simply by

switching from conventional fossil gas to RNG, she said. That could

prevent existing steam methane reformers from simply switching to

using RNG to win the tax credit, although it would allow newly built

facilities designed to use RNG.

But Treasury’s guidance does state that it will seek public comment on

proposals that could allow broader use of RNG for hydrogen production,

she said. It also lays out plans to find ways to use “fugitive

methane,” such as the methane that escapes from coal mines to pollute

the atmosphere, if it can be captured and put to use for hydrogen

production instead.

The Union of Concerned Scientists and other environmental groups are

urging the Treasury Department to tread carefully in crafting these

rules. They argue against allowing blue-hydrogen producers to use the

most common RNG emissions accounting methods to justify earning 45V

tax credits — particularly those that involve negative

carbon-intensity scores like those that livestock manure methane now

receives under California’s Low Carbon Fuel Standard.

“If you count it as anything less than zero, you’re ‘trueing up’

polluting from another existing source,” she explained. For example, a

steam methane reformer operator could continue to use fossil gas for

most of its hydrogen production but augment it with some

negative-carbon-intensity RNG that, on paper, counterbalances the

real-world carbon emissions that continue to pour out of its facility,

she said.

Wolak noted that the Fuel Cell and Hydrogen Energy Association has

joined a number of other hydrogen industry groups in advocating for

rules that would allow blue-hydrogen producers to use RNG in ways that

align with existing RNG tracking and verification systems.

“We would not want to see limitations to the use of RNG that could

otherwise really assist in producing low-carbon and reduced-carbon

hydrogen, and set barriers that would have an unintended consequence

of limiting the amount of hydrogen that can be produced,” he said.

But the Treasury Department’s guidance does note that it considers

existing RNG tracking and verification systems to have “limited

capabilities” that will need to be addressed before they could be

adapted for use for claiming the 45V tax credits.

Its list of flaws includes the fact that existing systems “do not

clearly distinguish between inputs” or “verify or require

verification of underlying practices claimed by RNG production

sources,” providing little or no underlying data with which to test

claims of emissions-intensity of RNG sources.

That could give the Biden administration a strong basis for barring

these methods from being used for 45V accounting methods, McNamara

said. It also has the authority to require hydrogen producers to use

only RNG that’s directly delivered to them, rather than using

“book-and-claim” processes.

These kinds of steps will be vital if the Treasury Department wants to

avoid the prospect of today’s dirty hydrogen producers signing

contracts with dairy farms and other sources of RNG that allow them to

earn the top tier of 45V tax credits for hydrogen they continue to

make from fossil gas, Rote said.

“For the lower tax-credit tiers, the differences between 45V and 45Q

are not that different,” she said — about 10 to 20 cents more per

kilogram of hydrogen for 45V than for the 45Q tax credits for the

amount of carbon captured for the equivalent amount of hydrogen

production. “So in those cases, it’s likely that a producer might opt

for 45Q.”

“But it is really significant for the top tax-credit tier of $3 per

kilogram,” she said. “If there’s a pathway for those producers to

receive the full 45V credit — for example by blending with RNG —

that’s where you see the pressure to go after the top tier.”

Sara Gersen, a senior attorney in the Clean Energy Program at

nonprofit group Earthjustice, agreed that “the prospect of a facility

being able to generate these very, very generous tax credits for gray

hydrogen with a smattering of biomethane in the feedstock is quite

problematic.”

The Treasury Department could avoid that outcome, she said. “One of

the major things we’re going to be asking for is to ensure that no

biomethane resource is treated as a carbon-negative resource,” she

said. “If we were to treat biomethane from swine and cow manure the

same way we treat biomethane from landfills, this wouldn’t be an

issue.”

“I have some optimism that Treasury is going to read our comments

carefully and implement rules that avoid that outcome,” she added.

“They’re trying to incentivize innovation,” not help companies

“create dirty hydrogen and greenwash it.”

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212

|