|

-+

Return To Main Page

Contact Us

April 8,

2024

By Geoffrey Seiler

Will Plug Power Survive 2024?

Key

Points

Plug Power issued a "going concern" warning late

last year, before removing it earlier this year.

The company has been plagued by poor gross margins

and project delays.

It's currently looking for government financing to

finish two hydrogen production facilities.

The company issued a warning last year that often precedes a bankruptcy

filing.

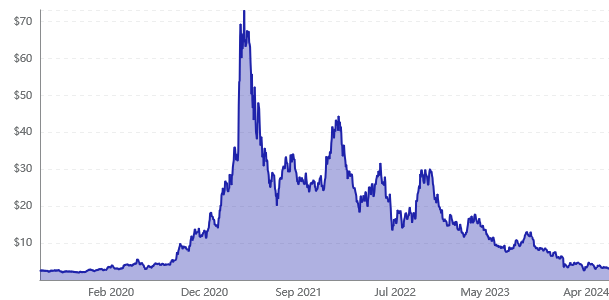

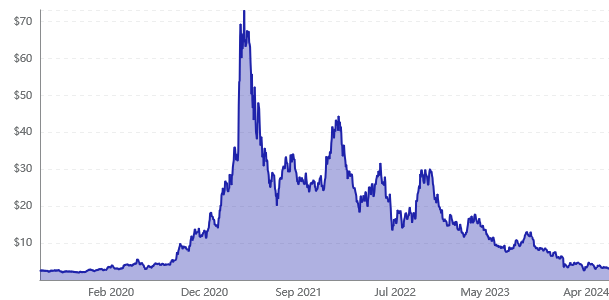

It's been a difficult few years

for Plug Power

(PLUG

3.85%), which has seen its stock fall from over $70 in

early 2021 to under $4 today.

In November 2023, when it filed its 10-Q for the

third quarter, the company issued what is referred to as a "going

concern" warning projecting that it may not have enough cash to fund its

operations and capital expenditure requirements over the next 12 months.

Such warnings are often a prelude to a company filing bankruptcy.

However, Plug Power removed the warnings in its 10-K filing in late

February.

Let's take a look at Plug Power and see if the

company can turn itself around, or if bankruptcy could still be in the

cards.

A struggling business

Plug Power is trying to become an end-to-end

hydrogen solutions company that offers everything from hydrogen

production to storage to hydrogen fuel cells. Currently, the company's

main product is a fuel cell used in forklifts and other material

handling equipment that's used in high-volume warehouses and

distribution centers. It counts well-known companies such as

Amazon, Walmart, and Home Depot

among its clients.

The problem with its business

model is that Plug Power sells the hydrogen fuel to its customers to run

these fuel cell-powered forklifts at huge losses. This has led the

company to have negative gross margins, and even larger operating

losses. As a result, the company has been bleeding cash. In 2023, it had

operating cash flows of negative $1.1 billion and it consumed $1.8

billion in total cash including capital spending.

Building green hydrogen production

facilities

Plug Power's current business model is not

sustainable, which is why the company began looking to build out its own

green hydrogen production facilities. The goal is that by producing its

own green hydrogen, the company would be able to sell hydrogen fuel to its

customers profitably, instead of selling the fuel at a loss.

The problem the company has run into is that the

cost to build hydrogen production plants is quite high, and new projects

often come with delays. Plug Power was initially aiming to have five

hydrogen production facilities up and running by the end of July 2024.

Currently, its Georgia plant is the only one operational, while a plant in

Tennessee is expected to come online soon. The Georgia plant would be able

to handle around 20% to 25% of its customers' material handling fuel

demand, with the Tennessee plant handling about another 15%. The company

has also formed a joint venture with Olin Corporation to

help fund its plant in Louisiana.

Meanwhile, Plug Power is slowing

down its investments in facilities in New York and Texas until it can find

better financing options. It also plans to reduce overall

capex to help lower its cash burn by 70% compared to 2023. It is

looking for low-cost financing from the Department of Energy (DOE) to

finish its facilities in New York and Texas. In March, the DOE granted the

company nearly $76 million toward building the plants, but Plug Power's

still waiting on a $1.6 billion loan that it had applied for to finish the

projects.

Ambitious plans and threat of bankruptcy

Plug Power had previously set out ambitious plans of

generating $20 billion in revenue with 35% gross margins in 2030. However,

management has lost a lot of credibility with investors given the

continued push-out of its hydrogen plants coming online and the issuance

of a "going concern" warning.

Moving forward, the company should

survive through at least the end of this year. It was able to secure a $1

billion at-the-market security issuance (ATM) agreement to sell newly

issued shares through or to financial services firm B. Riley,

which will add additional cash to its coffers. Meanwhile, if the Georgia

and Tennessee hydrogen plants run smoothly, that should help improve its

weak fuel margins. If the company receives the DOE loan it applied for,

that will only improve its liquidity more and allow it to continue to

build its remaining two hydrogen facilities.

That said, Plug Power remains a very risky stock

to own at this point. The company has yet to prove it can generate

positive gross margins, let alone profits or

cash flow. At the

same time, it has plans to further dilute investors and add to its debt

load. This is a stock best left to watching from the sidelines.

Should you invest $1,000

in Plug Power right now?

Before you buy stock in Plug Power,

consider this:

The Motley Fool Stock Advisor analyst

team just identified what they believe are the 10

best stocks for investors to buy now… and Plug Power wasn’t

one of them. The 10 stocks that made the cut could produce monster

returns in the coming years.

Consider when Nvidia made

this list on April 15, 2005... if you invested $1,000 at the time of our

recommendation, you’d have $533,869!*

Stock Advisor provides investors with

an easy-to-follow blueprint for success, including guidance on building

a portfolio, regular updates from analysts, and two new stock picks each

month. The Stock Advisor service has

more than quadrupled the

return of S&P 500 since 2002*.

See the 10 stocks

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|