|

-+

Return To Main Page

Contact Us

April 16, 2024

By OilPrice.com

OIL PRICE INTELLIGENCE REPORT

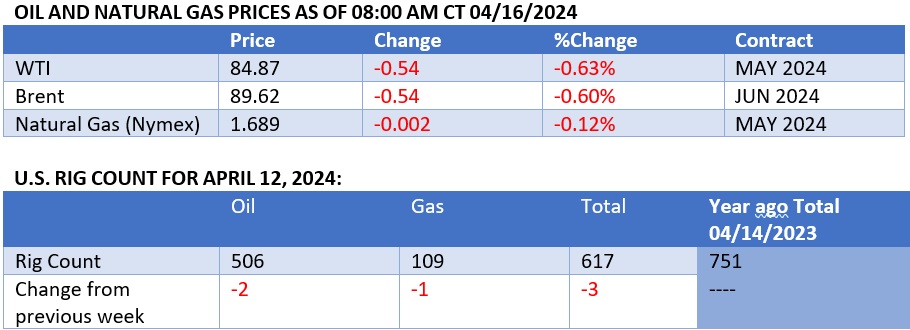

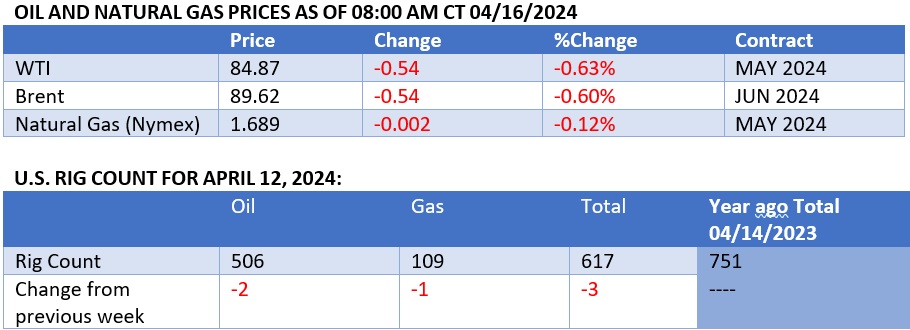

Oil prices have fallen back at the

start of this week despite heightened geopolitical risk after Iran

attacked Israel with more than 300 missiles and drones. Traders appear

to be focused on fundamentals, awaiting a more tangible event for oil

markets before pushing prices any higher.

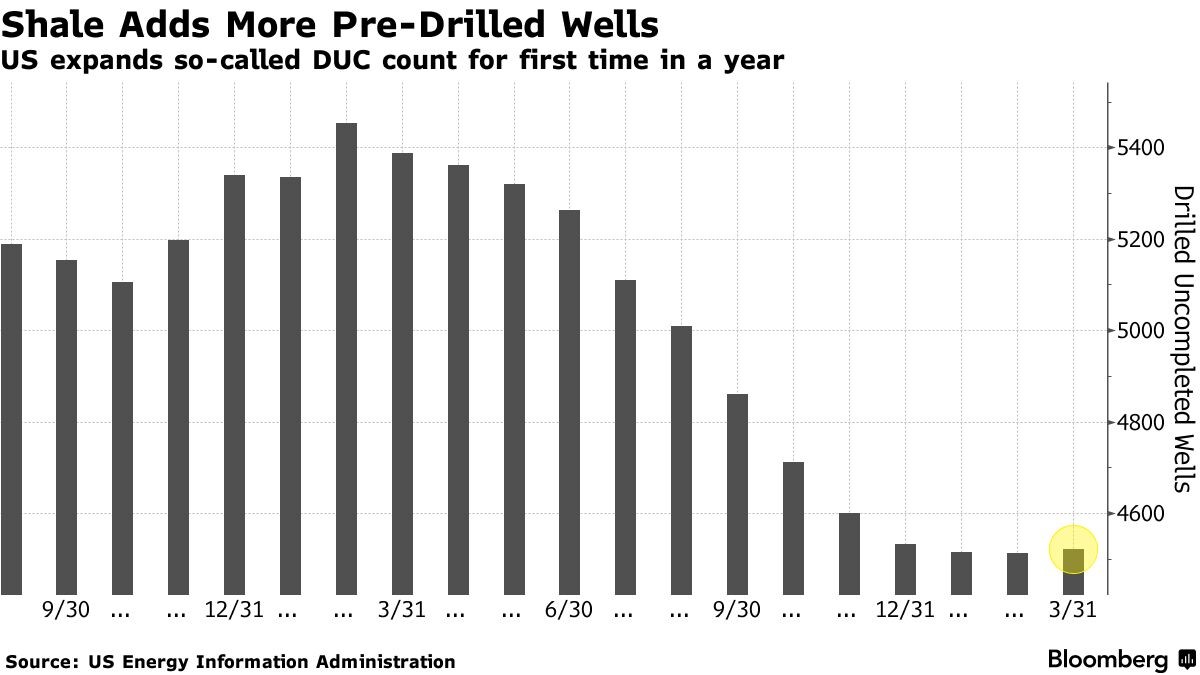

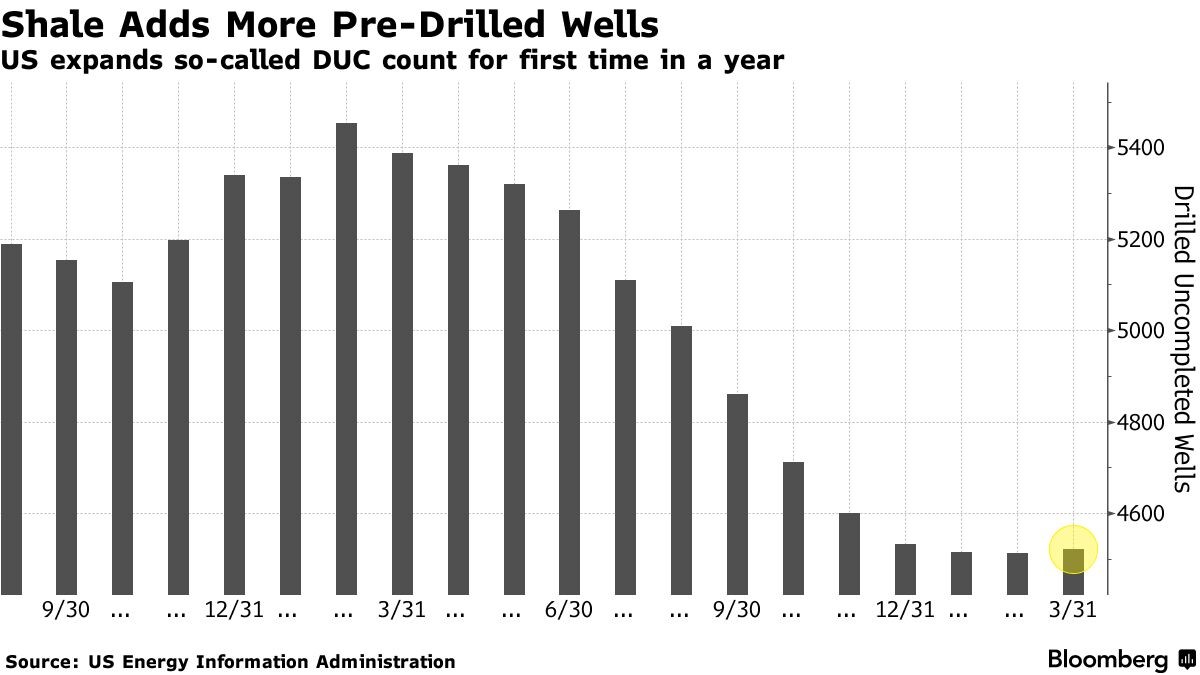

- For the first time in more than a

year, the US count of drilled-but-uncompleted wells (DUCs) rose in

March to 4,522, up 9 wells compared to February,

signaling

that US production growth is stalling.

- Usually, when companies start to build up fracklogs, it is an

indication that companies wait for periods of higher prices or, in the

case of the US, easier access to pipelines, but this year neither of

those seems to be pertinent.

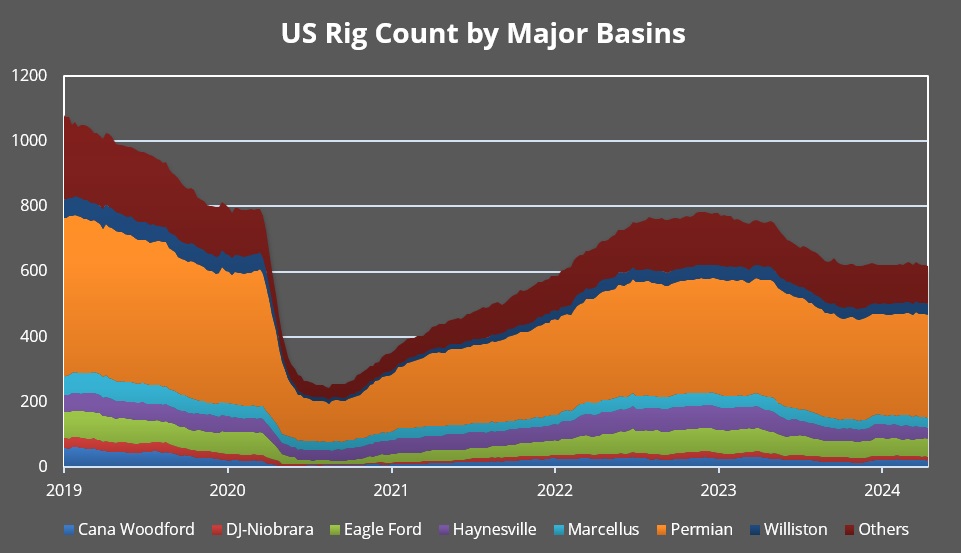

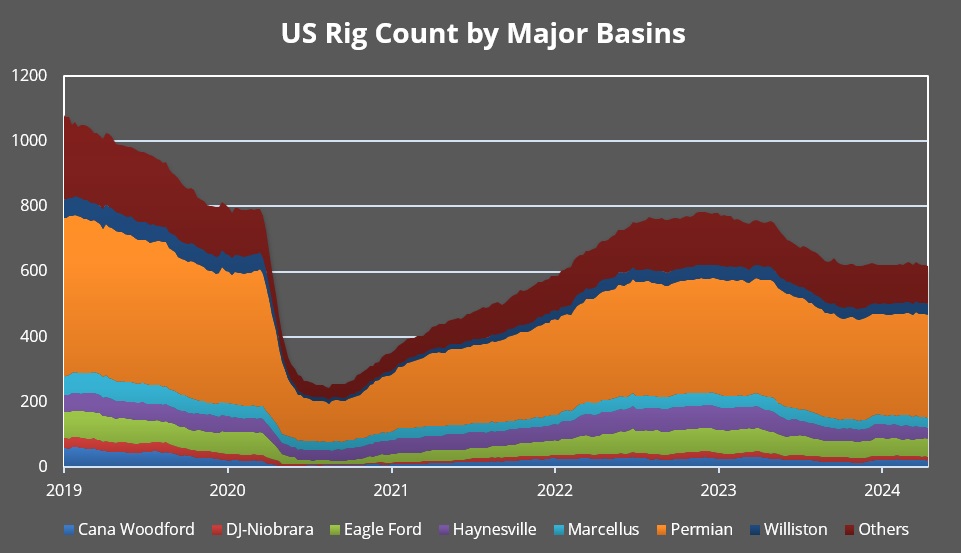

- The EIA expects US shale oil production to be steady at 9.86 million

b/d, below the 10 million b/d record pace seen in December, with the

Permian Basin stagnating, too.

- Only Niobrara and Eagle Ford saw their DUC count decline last month,

even the Permian Basin which cleared more than 550 wells from its

fracklog since 2022 saw its DUC count move up by 4 wells.

Market Movers

- US natural gas firm EQT (NYSE:EQT)

agreed to

sell its 40% non-operated interest in the Marcellus and Utica basins

in exchange for Equinor’s (NYSE:EQNR) onshore assets

in the Appalachian basin and $500 million in cash.

- French oil major TotalEnergies (NYSE:TTE)

signed a

memorandum of understanding with Algeria’s NOC Sonatrach to develop

gas fields in the Timimoun region, concurrently expanding its LNG deal

with Algeria through 2025.

- Brazil’s President Lula

called off

plans to sack Petrobras (NYSE:PBR) top executive Jean

Paul Prates, but there is still no clarity on the company’s dividend

policy ahead of its April 25 shareholder assembly.

Tuesday, April 16, 2024

The oil markets closely monitored Iran’s retaliatory strikes over the

weekend and, at least for the time being, risks of a wider regional

conflict have subsided this week, sending Brent back to $90 per

barrel. There are still plenty of bullish factors to look out for,

most notably the price might swing up should the US decide to sanction

Venezuela again, a decision due on April 18th.

OPEC Woos Namibia to Replace Angola.

Bouncing back from the loss of Angola, the OPEC+ oil group is actively

courting Africa’s Namibia, a country yet to produce oil but set to

rise to 700,000 b/d by 2030,

seeking to

get Namibian authorities to join its Charter of Cooperation just like

Brazil did.

ADNOC Mulled BP Takeover. ADNOC, the

national oil company of the United Arab Emirates, has

reportedly

considered buying UK oil major BP (NYSE:BP) after the

110 billion company underperformed its competitors for years, but

talks did not progress beyond preliminary discussions.

India Asks Power Generators To Keep Producing.

Powered by India’s stellar economic growth, the country has

mandated coal-fired power plants to guarantee maximum electricity

output until 15 October, poised to lift coal imports as temperatures

are expected to be higher than average in the summer.

Earthquakes to Tighten Saltwater Control in the US.

Shale oil producers might be facing further

restrictions

on saltwater disposal after a 4.4 magnitude earthquake shook Midland

after the Railroad Commission of Texas already developed guidelines to

avoid tremors over magnitude 3.5.

US, UK Ban Russian Metals Trading. The US

and the United Kingdom

banned

metal-trading exchanges from accepting new aluminum, copper, and

nickel produced in Russia, simultaneously prohibiting the imports of

those metals into the two countries, impacting the LME and CME.

Nigeria’s Power Grid Collapses Again.

Nigeria’s electricity grid collapsed for the fifth time this year

already, just two weeks after the African country’s Tinubu

administration raised power tariffs for wealthier consumers by 230%,

trying to scrap the $2.6 billion worth of subsidies for the sector.

Investors Turn Bullish on US Gasoline. Money

managers and other hedge funds have

built up one

of the largest bullish positions in US gasoline futures as sticky

inflation and higher oil prices keep the pressure on gas prices, with

net length rising to 84,926 contracts for Nymex RBOB, the highest

since January 2021.

Kazakhstan Promises to Comply with OPEC+.

Citing bad weather and heating season requirements, Kazakhstan

admitted it

exceeded its OPEC+ oil production quota by 131,000 b/d in March,

pledging to compensate for the overproduction over Q3 alongside Iraq.

US Warns Venezuela to Stick to Plan. The US

State Department

warned

Venezuela that the White House would not renew a temporary sanctions

waiver on the Latin American country that expires on April 18 unless

Maduro shows progress on political rights and fair elections to be

held this July.

China Builds Stocks from Russian Imports.

China’s state-run offshore giant CNOOC (HKG:0883) has

been

buying up

Russia’s ESPO crude into a newly launched reserve base in east China’s

Dongying port, boosting the Asian country’s strategic stocks with

discounted oil.

Exxon Greenlights Guyana’s Sixth Project.

The consortium led by ExxonMobil (NYSE:XOM) developing

Guyana’s Stabroek block approved the $12.7 billion Whiptail project,

the sixth development in the South American country, aiming 250,000

b/d of output starting from 2027.

Copper Rallies as Chinese Production Cuts Get Real.

Copper futures are

trading at

their highest since June 2022, soaring to $9,650 per metric tonne,

after satellite data confirmed that the inactivity of Chinese smelters

rose to 8.5%, more than double the 4% rate in Q4 2023.

Oil Service Majors Feel the M&A Pressure.

Following SLB’s $8 billion takeover of ChampionX, oil service giants

Halliburton (NYSE:H) and Baker Hughes (NASDAQ:BKR)

will see increased

pressure to

join the buying spree, also buoyed by the US’ slowdown in activity.

Tom Kool

Editor, Oilprice.com

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|