|

November 21, 2023

By Oil Price

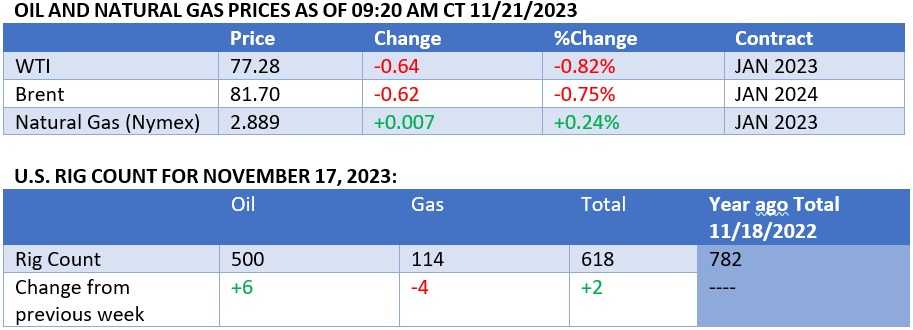

Oil Markets on Edge Ahead of Critical OPEC+ Meeting

Oil markets are now fully focused

on the upcoming OPEC+ meeting, with reports that the group may deepen

cuts being counteracted by an apparent lack of unity amongst OPEC

members on the issue.

Chart of the Week

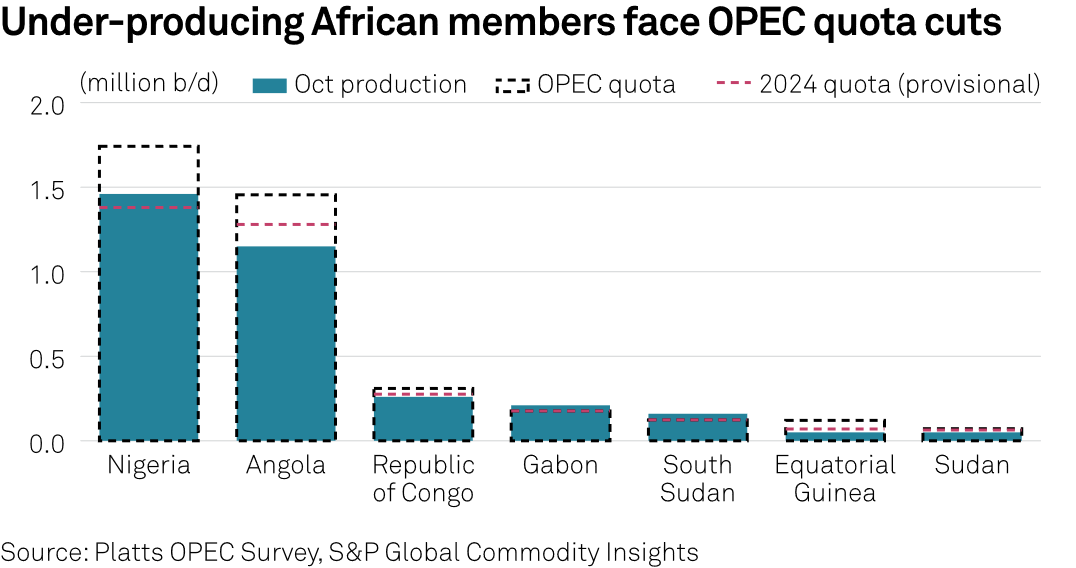

- As OPEC+ prepares for its meeting on November 26, African producers

are tacitly lamenting the oil group’s recalibration of 2024 production

targets that will curb the maximum amount Nigeria or Angola can

produce.

- Following tense negotiations in June, all African countries agreed they

would be subjected to lower 2024 quotas unless they could demonstrate

higher production capacity before November, partly explaining the

bumper production figures from Nigeria and Angola.

- Nigeria, pumping only 1.38 million b/d on average in the first half

of 2023, has been some 400,000 b/d below its OPEC quota, similar to

Angola which still carries a 1.46 million b/d quota despite production

averaging only slightly above 1 million b/d.

- Three upstream consultancies - Rystad, IHS, and WoodMac - have

submitted their African production capacity figures to the OPEC

secretariat and the OPEC+ meeting is believed to be deciding on their

fate this Sunday.

Market Movers

- Backed by BlackRock, Canadian power generation firm Capital

Power (TSE:CPX) agreed to

buy two natural gas-fired power plants in the US for $1.1 billion from

Beal Financial, making it North America’s fifth largest operator.

- The merger of Chesapeake Energy (NASDAQ:CHK) and Southwestern

Energy (NYSE:SWN) might be the next big thing in US M&A

activity after investor Kimmeridge came out in support of

the prospective deal.

- Australia’s Karoon Energy (ASX:KAR) agreed to

buy a 30% stake from operator LLOG in the Who Dat and Dome Patrol oil

fields in offshore Louisiana, paying $720 million to break into the US

Gulf Coast.

Tuesday, November 21, 2023

Oil markets are once again on edge ahead of the OPEC+ summit this

weekend, with calls for deeper cuts circulating concurrently to rumors

of OPEC members not being ready to agree on any coordinated response.

Hence, Monday’s spike that saw Brent move back to $82 per barrel had

tapered off by Tuesday morning. Barring a surprise in this week's U.S.

oil inventory report, all the attention will be geared toward Vienna

over the weekend.

Argentina’s New President Lifts Commodity Stocks. Argentina’s

oil stocks have soared by as much as 40% Monday after libertarian

candidate Javier Milei was announced the

winner of the presidential election run-off, pledging to nationalize YPF

(NYSE:YPF), shrink the government, and cut taxes.

Houthis Seize Israel-Linked Cargo Ship. Yemen’s

Houthi militias have seized the

Israel-linked cargo carrier Galaxy Leader as it was transiting the Red

Sea, threatening to do the same with any other ships passing offshore

Yemen and adding a new layer of maritime security risks for shippers.

Russia Lifts Gasoline Export Ban. Citing

surplus domestic supply and lower prices, Russia’s energy ministry scrapped restrictions

on gasoline exports, introduced on September 21 to tackle fuel

shortages over the country, with some 150,000 b/d expected to be

exported from December on.

Saudi Arabia Keeps On Finding Gas. Saudi

Arabia’s national oil firm Saudi Aramco

(TADAWUL:2222) announced the

discovery of two new natural gas fields in the Empty Quarter Desert in

the country’s southern part, with both the al-Hiran and al-Mahakik

prospects showing commercial gas flow rates.

Venezuela Nears Deal with Trinidad. Following

months-long talks with Trinidad and Tobago as well as project operator Shell

(LON:SHEL), Venezuela is expected to

approve a 25-year license for the UK-based energy major to develop the

4.2 TCf Dragon field straddling their maritime border.

Lula Asks Petrobras to Generate More Jobs. Brazil’s

President Lula da Silva asked the CEO of national oil firm Petrobras

(NYSE:PBR) Jean-Paul Prates to modify the

company’s 2024-2028 investment plan to prioritize local job creation,

raising fears of more state intervention.

High Waters Hinder Europe’s Largest Shipping Artery. After

months of drought-induced freight restrictions, navigation along

the river Rhine has been limited as vessels en route to Switzerland

can no longer sail under bridges due to continuous rains.

Sri Lanka Wants to Become a Nuclear Nation. The

government of Sri Lanka has expressed its

interest in setting up nuclear power plants as it seeks to produce

cheap and reliable electricity, seeking to wean itself off its oil and

coal dependence and meet its 2050 carbon neutrality target.

US Still Can’t Find Source of Gulf Oil Spill. US

emergency response crews are trying to

locate the source of an oil spill in the US Gulf of Mexico reported

near the Main Pass Oil Gathering (MPOG) pipeline

some 19 miles off the coast of southeastern Louisiana, prompting a

swift pipeline halt.

Shell Pays UK Taxes Thanks to Windfall Tax. UK-based

energy major Shell (LON:SHEL) recorded its

first net corporate taxes in the UK last year after four consecutive

years of zero payments thanks to tax credits on investment and

platform decommissioning, paying $40.5 million in tax last year.

Panama’s Copper Woes Get Real. Canadian

miner First Quantum Minerals (TSE:FM) warned that

if Panama’s month-long blockade of the controversial Cobre Panama

copper mine doesn’t stop it would be forced to suspend operations at

the site, even before the country’s Supreme Court decides on its

future.

Angola Hopes for Revival of Onshore Drilling. A

total of 22 international and indigenous oil firms submitted 53

bids in Angola’s latest onshore licensing round in the mostly untapped

Lower Congo and Kwanza basins, as Angolan authorities hope to find new

sources of supply apart from offshore.

China Seeks to Boost Domestic Biodiesel Consumption. Despite

being one of the leading global exporters of UCO, China’s internal use

of biodiesel has been lukewarm, prompting the

National Energy Administration to launch several pilots to spur

domestic consumption of the non-fossil fuel.

Tom Kool

Editor, Oilprice.com

P.S. Whether you are new to the oil and gas industry or an

energy market veteran, you will regret not signing up for Global

Energy Alert. Oilprice.com's premium

newsletter provides everything from geopolitical analysis

to trading analysis, and all for less

than a cup of coffee per week.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212

|