|

By

Tim Quinson

October

17, 2023

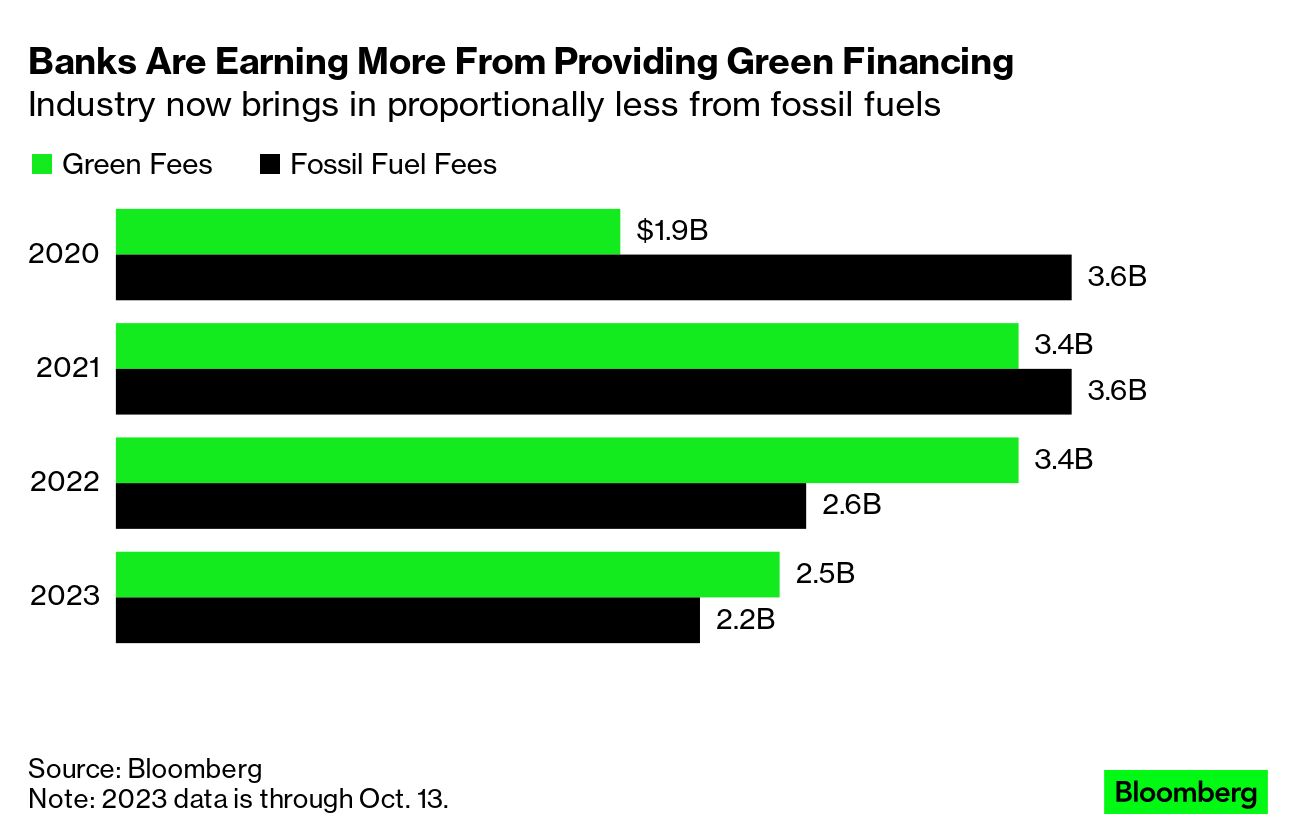

Green finance is growing — slowly

For a second straight year, banks are making more money providing

loans and underwriting bond sales for green-related projects than

they’re earning from fossil fuel companies.

Together, banks have generated about $2.5 billion of revenue from

climate-focused financing so far this year, compared with $2.2 billion

from their work with oil, gas and coal companies, according to data

compiled by Bloomberg.

It’s a big change from as recently as 2020, when lenders pocketed

almost double the fees from Big Oil than they did from backing green

initiatives.

Still, such a narrow green-to-fossil fuel ratio is far from where we

need to be, says Trina White, an analyst at BloombergNEF who focuses

on sustainable finance.

“It is promising to see evidence of what we have long known—that the

energy transition promises to be an enormous opportunity in addition

to a climate necessity,” she says.

White explains that the challenge will be ensuring the private sector

seizes on that opportunity in pursuit of 1.5C

scenarios, which are more likely to prevent catastrophic warming.

Doing that, however, will require an extraordinary ramp-up of

investment.

“We need to see both real-economy investment and bank financing in

low-carbon energy sources more than quadruple this decade relative to

fossil fuels,” she says.

BNEF analysts use a metric that tracks investment in the energy-supply

system across a range of industries. The analysts have determined that

the ratio of clean energy investment to fossil fuels needs to hit 4 to

1 by the end of the decade if the planet is to avoid the worst ravages

of climate change as laid out in the Paris Agreement of 2015. That

ratio was 0.8 to 1 at the end of 2021, according to BNEF.

Banks have faced considerable criticism in recent years for their

support of the fossil fuel industry, the primary source of

planet-warming pollution. Financiers have sought to defend themselves

by claiming they want to assist in the transition to a low-carbon

economy by staying engaged with the industries most responsible for

the accelerating climate crisis.

Additionally, growing numbers of banks have acknowledged the risks of

the crisis by increasing their ambitions around green financing. For

example, JPMorgan Chase & Co. announced emissions-reduction targets

late last year for airlines, cement manufacturers and iron-ore and

steel companies. That added to the bank’s first set of goals, which

focused on the oil and gas, electric-power and auto-manufacturing

sectors.

Bloomberg Intelligence analyst Grace Osborne says “net zero 2050”

represents an estimated $50

trillion investment opportunity based on estimates from the World

Economic Forum. The clean-energy transition has the potential to open

“significant new revenue streams,” she says, including more fees from

green-bond underwriting and lending, returns from investments in

low-carbon technology and revenue from other types of sustainable

financing.

Banks can capture “the climate upside” by attracting low-carbon

clients and persuading heavy polluters to decarbonize their

operations, Osborne says.

However, greenwashing among financial firms claiming sustainable

investments remains a perpetual threat. Tracking progress is difficult

because of the lack of standardization and market regulation, and

overall doubts about the veracity of the “impactful data” that banks

report related to sustainable finance, Osborne says.

That said, she says green-bond issuance is one area where it’s easier

to gauge results from the banks funding of low-carbon projects. This

year, BNP Paribas SA, Bank of America Corp. and Credit Agricole SA

stand out as the leading green-bond underwriters, according to

Bloomberg data. Overall, roughly $475 billion of green bonds and loans

have been arranged so far in 2023, up from closer to $450 billion in

the same year-earlier period.

By contrast, the opaque market for sustainability-linked loans—a big

market measuring about $1.3 trillion—comes with reputational risks for

the banks, Osborne warns. While the debt is designed to incentivize

sustainable impact through environmental, social or governance key

performance indicators (KPIs), a lack of disclosure around the

targets, plus the absence of adequate monitoring, puts the integrity

of the product in question, she says.

“The concern is the products are sometimes used as marketing tools,

and as a result, they present unfortunate regulatory, reputational and

greenwashing risks,” Osborne says.

Sustainable finance in brief

Despite it’s destructiveness to the atmosphere, ecosystems,

wildlife and humanity, Wall Street still loves coal. And it very much

wants to keep making money from it. With demand for coal still high,

financiers are eager to bring back the dirtiest of fossil fuels. But

how to do that defensibly amid accelerating climate disasters? The

latest proposal is that, by saying they’re helping coal producers

transition to a greener business model, it’s okay to profit off of it

in the interim. It may surprise some to find out that climate

activists are skeptical, saying it’s another ploy by the financial

industry to make as much money as possible from coal while it still

can.

Photographer: Sean Gallup/Getty Images

-

An executive at Goldman Sachs says there’s one

kind of ESG asset that has what it takes to defy short-seller

headwinds.

-

Banks in Europe will need to adjust the risk assessments they

conduct of their clients to reflect new ESG requirements enforced

by their

watchdog.

-

Some wondered if activist Engine No. 1’s victory over Exxon signaled

the beginning of the end for the oil giant’s fossil-fuel growth. It

didn’t.

More from

Green

Cities, countries and companies

have been forced to purchase water from farther-away places than ever

before due to increasingly acute scarcity. But that trade of H₂0

pales in comparison to another, hidden way that water moves around the

globe. Because it’s needed to make almost every raw material and

product that humans consume, the trillions of dollars in commodities

and goods exchanged every year also ultimately represent an exchange

of water. From broccoli farms to smartphone factories, Bloomberg Green

has tracked parts of this huge — and invisible — market for the

world’s most precious resource.

Greta gets charged by the Met. Climate campaigner Greta Thunberg was

charged by London police over Tuesday demonstrations that blocked

several top oil executives from entering an energy industry event.

Net-zero alliance reports falling emissions. A$9.5 trillion investor

group said greenhouse gas emissions enabled by its members’ lending

and investment activities declined for the first time, albeit

modestly.

Costs wreck offshore plans. BloombergNEF has revised its forecast for

offshore wind capacity in the US, saying it will now reach just 16.4

gigawatts by 2030 — a little more than half of Biden’s target.

Weather watch

By Brian K Sullivan

Tropical Storm Norma has formed in the Pacific off Mexico and is

forecast to gain strength, eventually striking near the resort area of

Cabo San Lucas as a Category 1 hurricane early Monday, the US National

Hurricane Center said. Tropical-storm strength winds of at least 39

miles (63 kilometers) per hour should reach the area at the tip of

Baja California by late Friday.

Norma was about 410 miles southwest of Manzanillo, Mexico with winds

of 65 mph early Wednesday, the center said. In 2014, a much stronger

Hurricane Odile struck the area killing at least 11 people, causing

more than $1 billion in damages and stranding close to 30,000 tourists

in the area.

.png)

Tropical Storm Norma Photographer: NOAA

Further to the west, Tropical Storm Sanba is

meandering around the Gulf of Tonkin, according to the US Joint

Typhoon Warning Center. While it may briefly strengthen, Sanba will

remain at tropical storm strength.

It will eventually make landfall in central Vietnam, which should

cause it to dissipate, the center said. Thunderstorms and rain are

forecast across the south, according to the Vietnam's National Centre

for Hydro-Meteorological Forecasting.

In other weather news:

US: Heat advisories are up across parts of central and southern

California. Temperatures of near 100F degrees are possible in the

Santa Cruz Mountains and Santa Clara Valley, including San Jose about

45 miles south of San Francisco through Thursday, the National Weather

Service said. The advisory also covers parts of the Bay Area and

residents are advised to limit outdoor activity.

Europe: A cold snap over northern Germany and the Nordics will spread

to the UK and parts of France by the weekend, according to forecaster

Maxar.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879 Cell, Pacific Time Zone.

General office: 509-254 6854

4501 East Trent Ave.

Spokane, WA 99212

|