Margin, Price, Revenue in the Farm Bill Commodity

Program Context

8

May

2023

By

Carl

Zulauf, Department of Agricultural,

Environmental and Development Economics

Ohio State University, Nick Paulson, Gary

Schnitkey, and Jonathan Coppess, Department

of Agricultural and Consumer Economics

University of Illinois

The increase in cost to produce crops since 2020 has focused attention

on the net return margin between gross revenue and cost of

production. This analysis finds that change in revenue has a notably

closer relationship to change in margin than does change in price. US

commodity programs use either price (i.e. Price Loss Coverage (PLC))

or revenue (Agriculture Risk Coverage (ARC) to trigger payments. This

analysis implies revenue is a better policy variable than price for

addressing financial stress due to low or negative margins.

Data and Methods

The analysis uses the cost of production data set maintained by USDA,

ERS (US Department of Agriculture, Economic Research Service). It

currently covers the 1975-2022 crop years. Crops included in the data

set since 1975 are barley, corn, cotton, oats, peanuts, rice, sorghum,

soybeans, and wheat. We use the cost of production data for the US.

This data can also be thought of as the cost of production for the

average producer of the crop in the US.

Net return margin equals gross revenue minus total economic cost of

production (See Data Note 1). USDA, ERS assigns a cost to all inputs,

including an opportunity cost for owned land and unpaid labor. Hence,

it is an economic cost of production. We specifically calculate the

share of the change in margin explained by the change in price and

change in revenue. Explained share, or explanatory power, is the

squared correlation between change in margin and change in price or

revenue. Change is examined instead of level because price and

revenue have trended higher over time. Trends in variables can result

in misleading correlations. Moreover, change is often of more

interest, such as when margin declines notably. The explanatory power

calculated in this analysis is unconditional since there is only 1,

not multiple explanatory variables. Commodity programs are also

unconditional since they use a single metric, price (i.e. PLC) or

revenue (i.e. ARC) to trigger payments.

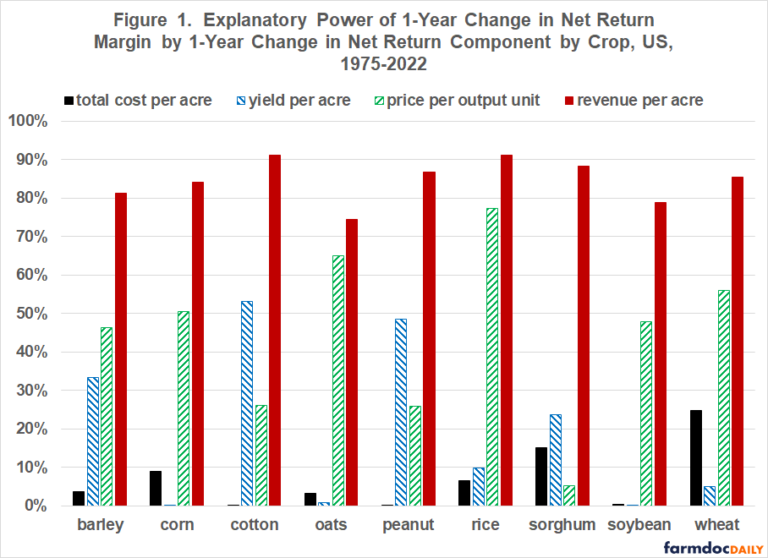

Individual Crop -1-Year Change

For each of the 9 crops, change in revenue explains a higher, often

notably higher, share of change in margin than does change in price

(see Figure 1). Explanatory power of change in revenue ranges from 83

percentage points (pp) higher for sorghum (88% -5%) and 65 pp higher

for cotton to 14 and 9 pp higher for rice and oats, respectively. For

comparative purposes, explanatory power for change in yield and total

cost per acre was also computed. They are much lower, especially

relative to change in revenue.

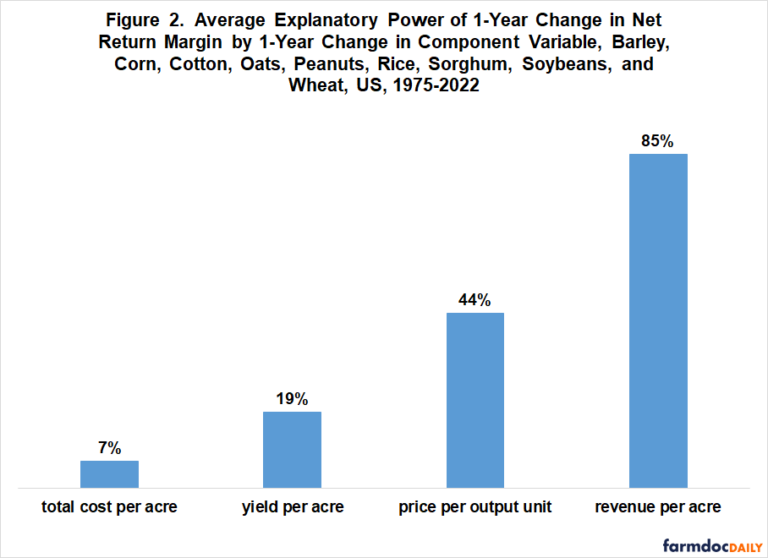

Average Relationship – 1-Year Change

Explanatory power for the individual crops was averaged to obtain the

general relationship for the 9 crops. The general relationship is of

interest because many features of commodity programs are similar

across program commodities. On average, year-to-year change in

revenue explains a notably higher share of the year-to-year change in

margin than does year-to-year change in price: 85% vs. 44% (see

Figure 2).

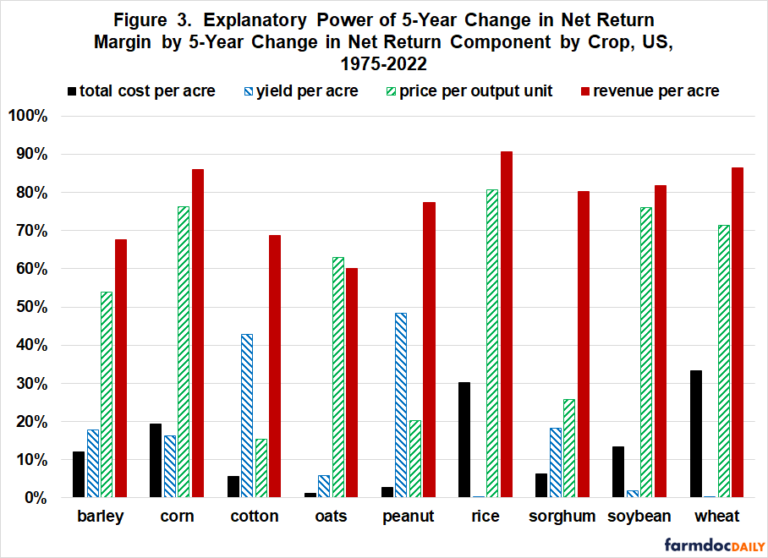

5-Year Change

To examine the sensitivity of the above results, a correlation was

calculated for 5-year change (such as, 2015 to 2020) instead of

year-to-year change (such as, 2015 to 2016). Change in input and

output prices can follow different time paths with input price change

often lagging output price change (see, for example, farmdoc

daily April 4, 2023). Differential price change can result

in differential change in margin over different time periods. Five

years is also a common farm bill length. Perspective is thus provided

on explanatory power for a shorter (1 year) and longer period (5

years).

For 8 crops, 5-year change in revenue has a higher explanatory power

of the 5-year change in margin than does the 5-year change in price.

Explanatory power of the 5-year change in revenue ranges from 57 pp

higher for peanuts (77% – 20%) to 6 pp higher for soybeans (82% –

76%). The exception is oats, for which explanatory power is 3 pp

higher for 5-year change in price (63% – 60%).

On average for the 9 crops, change in revenue continued

to explain a notably higher share of change in margin than does change

in price, but the average difference narrowed from 41 pp (85% – 44%)

to 24 pp (78% – 54%) (see Figure 4). Average explanatory power for

change in total cost and yield per acre remains much lower.

Discussion

Using US data for 9 large acreage field crops,

change in revenue is found to more closely track change in net

return margin than does change in price over the 47 year period,

1975-2022.

For the 9 crops as a group, change in revenue, on average,

explains between 78% and 85% of the change in margin, a high

explanatory power especially for a single variable relationship.

Change in price explains, on average, 44% to 54% of the change in

margin. The range in explanatory power for revenue and price

reflects change over 1 and 5 year periods.

Change in revenue explained a higher share of the change in

margin, often a much higher share of the change in margin, than

did change in price for 17 of the 18 crop and length of change

observations examined in this analysis (9 crops and 2 changes of 1

and 5 years).

The closer relationship of change in revenue with change in margin

should not come as a surprise. Revenue is a more complete measure

of returns than price since revenue also includes yield.

The finding has an important implication for the current farm bill

debate. If Congress wishes to increase the efficacy with which

current commodity programs address financial stress due to low or

negative net return margins, revenue is a better policy instrument

than price.

Data Note

USDA, ERS cost of production data includes both

revenue from the primary product, such as grain, and secondary

products, such as straw. Except for cotton, we use revenue only

from the primary product, i.e. its price times its yield, since

commodity programs only cover the primary product. For cotton,

seed cotton is the program crop, which includes both the value of

cotton lint and cottonseed. For a more detailed discussion of

USDA, ERS cost of production data, see the 2022

article by Zulauf, Langemeier, and Schnitkey in the Journal

of the American Society of Farm Managers and Rural Appraisers.

References and Data Sources

Paulson, N., G. Schnitkey, S. Sellars, C. Zulauf

and J. Baltz. “Update

on Growth Rates of Fertilizer, Pesticide and Seed Costs Over Time.” farmdoc

daily (13):62, Department of Agricultural and Consumer

Economics, University of Illinois at Urbana-Champaign, April 4,

2023.

US Department of Agriculture, Economic Research Service. May

2023. Cost of Production. https://www.ers.usda.gov/data-products/commodity-costs-and-returns/

Zulauf, C. M. Langemeier, and G. Schnitkey. 2022. U.S. Crop

Profitability and Farm Safety Net Payments since 1975. Journal

of the American Society of Farm Managers and Rural Appraisers.

Pages 60-69. https://www.asfmra.org/resources/asfmra-journal/2022journal

Disclaimer: We request all readers,

electronic media and others follow our citation guidelines when

re-posting articles from farmdoc daily. Guidelines are available here.

The farmdoc daily website falls under University of Illinois copyright

and intellectual property rights. For a detailed statement, please see

the University of Illinois Copyright Information and Policies here.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|